The currency war is over, says HSBC

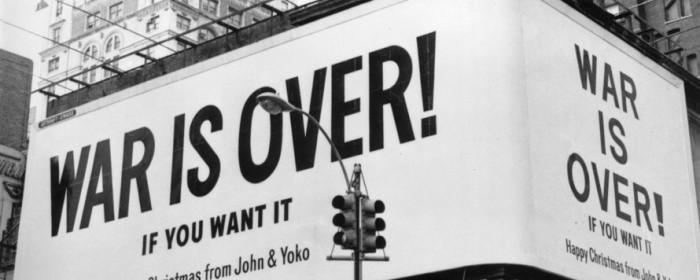

The currency war is over.

With the dollar clocking significant declines against the euro and yen since the beginning of the year, it appears that the European Central Bank and the Bank of Japan—who along with the Fed comprise the primary antagonists—have run out of ammunition for driving their currencies lower, according to a team of currency strategists at HSBC.

Investors should welcome this development. The only beneficiaries of the strong dollar were the BOJ and ECB. The strength in the greenback exacerbated global woes by causing emerging-markets currencies and oil prices CLK6, -4.15% to plunge—a one-two punch for oil-exporting developing economies.

A currency war occurs when central banks take turns using monetary policy to deliberately weaken their currencies in a scramble to gain an advantage. The resulting race to the bottom can prove counterproductive.

Read: Here’s one argument why China will lose its currency war

Read: The free market wins the currency war in China

Read: To stave off currency war, is it time for a coordinated response to the Chinese yuan?

Read: The dollar joins the currency wars

That’s all over—for now, at least, the HSBC analysts said. It’s likely that the euro will remain stronger as the ECB has given up trying to push it lower. Meanwhile, the yen will likely hover around its current levels.

In Europe, the ECB has opted to shift the emphasis to expanding credit by introducing targeted longer-term refinancing operations and by authorizing the purchase of some corporate debt.

The Bank of Japan tried switching to negative interest rates to weaken the currency because the number of Japanese government bonds available for purchase has dwindled.

“I think it’s generally acknowledged that [those central banks] welcomed a weaker currency,” said Daragh Maher, HSBC’s U.S. head of currency strategy and one of the report’s authors.

It’s good for other central banks, who can stop chasing the BOJ and ECB, he said.

Analysts have competing views about what’s driven the strength in the euro and yen since the start of the year. Some have cited a flight to safety, as global-market turmoil during the first six weeks of the year weighed on equities and lured investors into assets that are perceived as less risky.

Because Japan is the world’s largest creditor nation, the yen tends to strengthen during tumultuous periods as Japanese investors repatriate their money.

Others have said China could be buying up euros and yen, and their corresponding sovereign debt, as it seeks to diversify its foreign currency reserves away from the dollar.

HSBC first started writing about the so-called currency war in early 2012, near the beginning of the dollar’s long-term rally.

The euro EURUSD, -0.2942% has gained 3.4% against the dollar since the year began, while the dollar USDJPY, +0.02% has slid 7.4% against the yen.