Overnight News 8/25-26/15

During Every Market Crash There Are Big Ups, Big Downs And Giant Waves Of Momentum

This is exactly the type of market behavior that we would expect to see during the early stages of a major financial crisis. In every major market downturn throughout history there were big ups, big downs and giant waves of momentum, and this time around will not be any different. As I have explained repeatedly, markets tend to go up when things are calm, and they tend to go down when things get really choppy. During a market meltdown, we fully expect to see days when the stock market absolutely soars. Waves of panic selling are often followed by waves of panic buying. As you will see below, six of the ten best single day gains for the Dow Jones Industrial Average happened during the financial crisis of 2008 and 2009. So don’t be fooled for a moment by a very positive day for stocks like we are seeing on Tuesday. It is all part of the dance.

This is exactly the type of market behavior that we would expect to see during the early stages of a major financial crisis. In every major market downturn throughout history there were big ups, big downs and giant waves of momentum, and this time around will not be any different. As I have explained repeatedly, markets tend to go up when things are calm, and they tend to go down when things get really choppy. During a market meltdown, we fully expect to see days when the stock market absolutely soars. Waves of panic selling are often followed by waves of panic buying. As you will see below, six of the ten best single day gains for the Dow Jones Industrial Average happened during the financial crisis of 2008 and 2009. So don’t be fooled for a moment by a very positive day for stocks like we are seeing on Tuesday. It is all part of the dance.And if stocks go up tomorrow (which they probably should), all of those same “experts” will be proclaiming that the “correction” is over and that everything is now fine.

Six of the ten largest point gains in the history of the stock market occurred between September 2008 and March 2009. That’s right. During one of the greatest market collapses in history, the market soared by 5% to 11% in one day, six times. Here are the data points:2008-10-13: +936.422008-10-28: +889.352008-11-13: +552.592009-03-23: +497.482008-11-21: +494.132008-09-30: +485.21Do you think these factoids will be shared with the public today on the stock bubble networks? Not a chance.

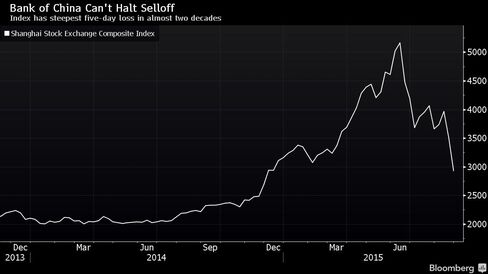

The Shanghai Composite, China’s main stock exchange, fell 7.6% on Tuesday – after losing 8.5% on what state media have called China’s “Black Monday”.It was the worst fall since 2007 and caused sharp drops in markets in the US and EuropeTokyo’s Nikkei index had a volatile day, closing 4% lower.

The People’s Bank of China has lowered its interest rate for the fifth time since November. The one-year lending has been reduced by 25 basis points to 4.6 percent; the one-year deposit rate has been cut by 25 basis points to 1.75 percent. The change comes into force on Wednesday.

I have no idea how this is going to play out, other than I know we are headed considerably lower. The fact that so few seem to understand what the actual problem is makes me even more confident about that point. It would seem that everyone is using the easy answer and blaming China, but that was just the catalyst. The market has been trading in a heavy sideways fashion for some time, expectations are way higher than can be met, the technical action has now deteriorated, and bad news actually matters at the same time that speculation has run rampant. As I have stated many times (and also noted the reasons why), you couldn’t create a more crash-prone environment if you specifically set out to do so.

|

Traders work on the floor of the New York Stock Exchange (NYSE) on August 25, 2015 in New York City. Following a day of steep drops in global markets, the Dow Jones industrial average rallied over 300 points in morning trading.(Spencer Platt/Getty Images/AFP)

BEIJING, Aug. 26 (Xinhua) — World markets experienced a “Black Monday” rout as anxiety over world economic prospects has been accumulated and fermented recently.

Meanwhile, world currency and commodity markets have also been affected by the new round of fluctuation.

Among the worst-hit, Chinese stock markets plummeted dramatically in two straight days, crashing to its lowest level since December 2014.

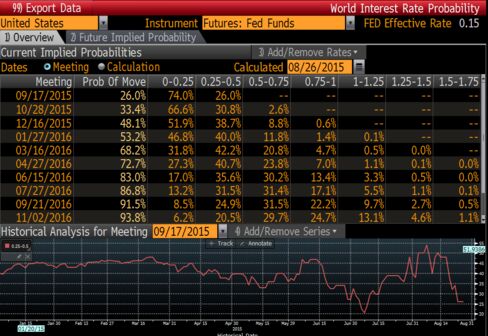

Analysts pointed out that the global markets’ tumbling was connected with a strong prediction of a possible hike in the U.S. Federal Reserve’s interest rates and uncertainties of the world economic recovery, having no direct links with China’s economy.

Though the plunge of global stock markets was started by Chinese volatile markets, said Tommy Xie, an economist at OCBC Bank in Singapore, the fundamental reasons are the anxiety aroused by U.S. interest rate hike predictions and fragile world economic recovery.

Since 2008 financial crisis, Chinese economy has acted as a stabilizer for global economy, he said, saying the recent adjustment to the RMB’s exchange rate mechanism made international investors who got used to China’s role of “an anchor” uncomfortable.

A trader gestures on the floor of the New York Stock Exchange at the start of the trading day in New York, New York, USA, 24 August 2015. Global markets have been reacting to the economic situation in China and the Dow Jones Industrial average followed that trend losing 1,000 points in early trading.(EPA/JUSTIN LANE)

With the prediction of the interest rate hike, currency value of countries like Russia, Singapore, Malaysia and other emerging economies have fluctuated severely over the past few months.

Moreover, the ongoing uncertainty about the timing of the interest rate hike may exacerbate the fluctuation.

Russ Koesterich, global chief investment strategist at BlackRock Inc., the world’s largest money manager, believed that the latest financial markets’ slump is a lagging response to multiple negative information, and is a combined result of concerns of investors over global economic outlook.

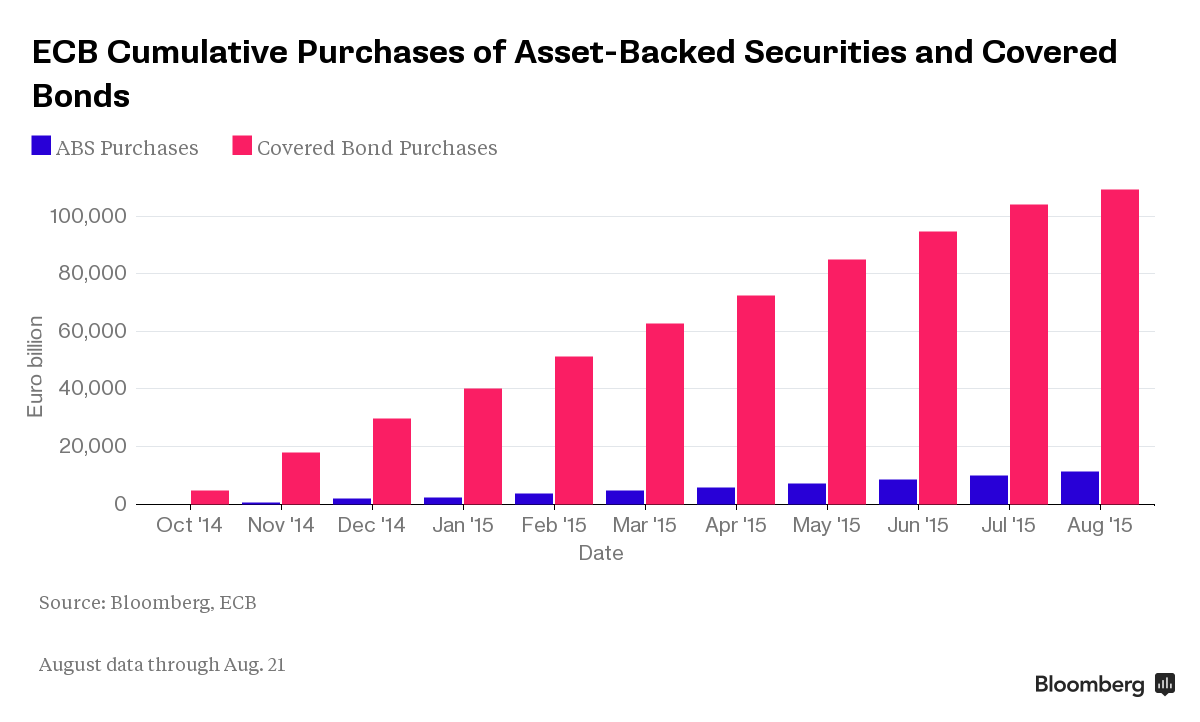

In fact, global economic recovery is still fragile and uneven, as developed countries, after the financial crisis, sought to use quantitative easing policy as a major measure to bolster their growth, which consequently resulted in twists and relapse of world economy.

However, the concern over Chinese economy is overdone, Larry Hu, head of Greater China Economics at Macquarie Group, said.

Traders work on the floor of the New York Stock Exchange at the start of the trading day in New York, New York, USA, 24 August 2015. Global markets have been reacting to the economic situation in China and the Dow Jones Industrial average followed that trend losing 1,000 points in early trading.(EPA/JUSTIN LANE)

In terms of economic foundamentals, the Chinese government still has ample space to unleash its most potent interventions, The Economist said.

Despite the weak performance of manufacturing and real estate, the rapid growth of the service sector is becoming the new highlight of China’s economy.

Charles Collyns, chief economist at the International Institute of Finance in Washington, dismissed the suggestion of another global financial crisis in the air.

He said “there are enduring factors that do imply a more enduring impact on the global economy,” but after the 1997 financial crisis that hit Southeast Asian countries, emerging economies freed up their currencies and capital markets, and their companies stopped depending excessively on what were once cheap dollar loans.

In addition, those countries enjoyed an adequate foreign exchange reserves, analysts said.

What’s important now is that all countries around the world unite and work together to surmount the current difficulties, avoid harmful results of competitive currency depreciation and capital markets’ contagious dive.

|

Investors’ Central Banking Saviors Caught Naked as Stocks Slide

-

Investors raise questions over potency of central banks

-

Policy makers may be more reluctant to inflate asset bubbles

China Devalues Yuan To Fresh 4-Year Lows, Arrests Top Securities Firm Exec As Stocks Slide Despite Rate Cuts

Submitted by Tyler Durden on 08/25/2015 – 22:17

Devaluation Stunner: China Has Dumped $100 Billion In Treasurys In The Past Two Weeks

The PBoC cut the RRR for all banks by 50bp and offered additional reductions for leasing companies (300bp) and rural banks (50bp). All these will take effect as of 6 September, and the total amount of liquidity injected will be close to CNY700bn, or $106bn based on today’s onshore exchange rate. In perspective, the PBoC may have sold more official FX reserves than this amount since the currency regime change on 11 August.

From an operational perspective, China’s FX reserves are estimated to be two-thirds made up of relatively liquid assets. According to TIC data, China held $1,271bn US treasuries end-June 2015, but treasury bills and notes accounted for only $3.1bn. The currency composition is said to be similar to the IMF’s COFER data: 2/3 USD, 1/5 EUR and 5% each of GBP and JPY. Given that EUR and JPY depreciation contributed the most to the RMB’s NEER appreciation in the past year, it is plausible thatthe PBoC may not limit its intervention to selling only USD-denominated assets.* * *China’s FX reserves are still 134% of the recommended level, or in other words, around $900bn (1/4 of total) and can be used for currency intervention without severely impacting China’s external position.

Is China Quietly Targeting A 20% Devaluation?

Submitted by Tyler Durden on 08/25/2015 – 19:08

Peter Schiff: Federal Reserve caused Black Monday crash, will launch QE4

Fund Winners and Losers in the Market Sell-Off

It’s too early to say whether the worst is over or if there’s more where that came from. (I’m betting on the latter.) But while the dust is settling on the current correction, it’s a good time to take stock of which fund categories have fared the best and worst during the sell-off, a roughly three-month period beginning in late May through late August. In many ways, it has been a classic “risk-off” market, with investors jettisoning high-risk assets and retreating to safer investment types like Treasuries. But there have been a few twists. If your portfolio is well diversified, you’ve held both poor performers as well as at least a few investments that have held their ground or even gained a bit during the rough patch. If everything in your portfolio has taken it on the chin, it’s a good idea to revisit your portfolio mix to ensure that you have enough diversification. (All data referenced in this article are through Aug. 24, 2015.)

Diversified U.S. Equity

Best-Performing Category: Small Growth

3-Month Return: -9.2%

Worst-Performing Category: Mid-Cap Value

3-Month Return: -11.6%

Returns among diversified U.S. equity funds have been fairly tightly bunched together during the current market weakness, with categories losing between 9% and 12%, on average, during the past three months through Aug. 24. Growth stocks outperformed value during the rally, so one might have expected them to sell off the most, too, but that hasn’t been the case. Not only do growth funds tend to eschew the hard-hit energy and basic-materials sectors, but investors have been concerned that China’s problems could slow the U.S. economy. Within such a climate, less-cyclical companies with strong internal growth would likely outperform.

It’s difficult to generalize about the list of funds that have held up extremely well during the current weakness, including ![]() Fairholme (FAIRX) and

Fairholme (FAIRX) and ![]() Conestoga Small Cap (CCASX). If there’s a commonality, it’s that they’re heavily concentrated in their top holdings and, therefore, more dependent on company-specific events than broad market sentiment. (For that reason, their recent down-market prowess may not be repeatable.) Defensively minded, cash-holding funds like

Conestoga Small Cap (CCASX). If there’s a commonality, it’s that they’re heavily concentrated in their top holdings and, therefore, more dependent on company-specific events than broad market sentiment. (For that reason, their recent down-market prowess may not be repeatable.) Defensively minded, cash-holding funds like ![]() AMG Yacktman(YACKX) and

AMG Yacktman(YACKX) and ![]() First Eagle US Value (FEVAX), which I mentioned in an article last week, have also held their ground, as have other quality-conscious offerings like

First Eagle US Value (FEVAX), which I mentioned in an article last week, have also held their ground, as have other quality-conscious offerings like ![]() Vanguard Dividend Growth (VDIGX).

Vanguard Dividend Growth (VDIGX).

Energy and basic-materials stocks have been the biggest casualties in the recent sell-off, as China’s woes translate into slack demand. Not surprisingly, energy-sector funds have been abysmal performers, as have precious-metals equity and commodity-focused funds. And among the worst-performing diversified U.S. stock funds during the current market rout are value-minded offerings that have bet heavily on energy stocks, basic-materials names, or both. ![]() Artisan Value (ARTLX),

Artisan Value (ARTLX), ![]() Goodhaven (GOODX), and

Goodhaven (GOODX), and ![]() Longleaf Partners (LLPFX) are among the worst-performing medalist funds in the past three months and for the year to date.

Longleaf Partners (LLPFX) are among the worst-performing medalist funds in the past three months and for the year to date.

Foreign Stock

Best-Performing Category: India Equity

3-Month Return: -10.0%

Worst-Performing Category: China Region

3-Month Return: -28.7%

China-region funds have been the worst-performing foreign-stock category during the past three months–no surprise there. But emerging-markets equity funds, in general, have taken it on the chin, in large part because so many emerging markets have been heavy exporters of commodities to China; as Chinese demand has declined, so have markets like Brazil and Mexico. The Indian market is an outlier, in that the country is a net importer of commodities like energy. While it hasn’t completely skirted global market weakness, especially recently, its losses have been smaller than other major emerging markets’. Every diversified emerging-markets fund that earns a medalist rating has lost at least 15% during the past three months, though ![]() American Funds New World (NEWFX) and

American Funds New World (NEWFX) and ![]() Virtus Emerging Markets Opportunities (HEMZX) have held up better than most. The former has benefited from its limited direct emerging-markets equity exposure, while the latter has fared better than its peers due to a heavy weighting in the India market.

Virtus Emerging Markets Opportunities (HEMZX) have held up better than most. The former has benefited from its limited direct emerging-markets equity exposure, while the latter has fared better than its peers due to a heavy weighting in the India market.

Beyond emerging markets, diversified foreign-stock funds’ losses have been no worse than–and in some cases better than–diversified U.S. equity funds’ during the recent market weakness. Share prices have fallen in developed foreign markets, but major foreign currencies have held their ground or even risen relative to the dollar, helping to stem losses. Not surprisingly, some of the usual conservatively managed foreign-stock suspects, such as ![]() Tweedy, Browne Global Value (TBGVX),

Tweedy, Browne Global Value (TBGVX), ![]() First Eagle Overseas (SGOVX), and

First Eagle Overseas (SGOVX), and ![]() IVA International (IVIOX) have held their ground well during the recent turbulence.

IVA International (IVIOX) have held their ground well during the recent turbulence. ![]() Fidelity Overseas (FOSFX) has actually gained ground during the recent market downturn, in part because of its limited exposure to emerging markets and heavy emphasis on Europe and the U.K.

Fidelity Overseas (FOSFX) has actually gained ground during the recent market downturn, in part because of its limited exposure to emerging markets and heavy emphasis on Europe and the U.K.

Many of the worst-performing diversified foreign-stock funds during the three-month period are those that have heavily emphasized emerging markets, including ![]() Dodge & Cox International Stock (DODFX),

Dodge & Cox International Stock (DODFX), ![]() Dodge & Cox Global Stock (DODWX),

Dodge & Cox Global Stock (DODWX), ![]() Artisan International (ARTIX), and various international-equity index funds with heavy exposure to emerging markets, such as

Artisan International (ARTIX), and various international-equity index funds with heavy exposure to emerging markets, such as ![]() Vanguard Total International Stock Index (VGTSX).

Vanguard Total International Stock Index (VGTSX).

Fixed Income

Best-Performing Category: Long Government

3-Month Return: 4.0%

Worst-Performing Category: Emerging-Markets Bond

3-Month Return: -7.0%

Bonds haven’t worked miracles during the recent market weakness, but they’ve generally done their job by holding up much better than equities and posting positive–or near-positive–returns in the past three months. Bond investors have retreated to perceived safe havens, boosting the fortunes of government bonds ahead of riskier fixed-income types. And because the China situation has raised questions about U.S. growth, many market watchers have questioned whether the Federal Reserve will boost interest rates next month; that has given longer-term bonds a shot in the arm. ![]() Vanguard Long-Term Treasury (VUSTX) was the best-performing medalist bond fund during the past three months. Among medalist funds in the core intermediate-term bond category,

Vanguard Long-Term Treasury (VUSTX) was the best-performing medalist bond fund during the past three months. Among medalist funds in the core intermediate-term bond category, ![]() JP Morgan Core Bond Select(WOBDX) and

JP Morgan Core Bond Select(WOBDX) and ![]() TCW Total Return (TGLMX) have held their ground well, in large part due to their exposure to the strong-performing mortgage-backed sector.

TCW Total Return (TGLMX) have held their ground well, in large part due to their exposure to the strong-performing mortgage-backed sector.

Not surprisingly, emerging-markets bond funds have fared the worst of any bond-fund type during the recent sell-off; within that group, those offerings focused on local-currency-denominated debt take up most of the slots on the laggards list. The Gold-rated ![]() Templeton Global Bond (TPINX), which lands in the world-bond category but includes a heavy weighting in developing-markets bonds, has posted losses higher than most emerging-markets bond funds during the sell-off. Credit-sensitive categories like high yield, multisector bond, and bank loans have all struggled in relative terms, too.

Templeton Global Bond (TPINX), which lands in the world-bond category but includes a heavy weighting in developing-markets bonds, has posted losses higher than most emerging-markets bond funds during the sell-off. Credit-sensitive categories like high yield, multisector bond, and bank loans have all struggled in relative terms, too. ![]() Loomis Sayles Bond (LSBRX), which lands in the multisector category, is having a year to forget, as is sibling

Loomis Sayles Bond (LSBRX), which lands in the multisector category, is having a year to forget, as is sibling ![]() Loomis Sayles Strategic Income (NEFZX).

Loomis Sayles Strategic Income (NEFZX).

Renminbi toolkit to help Canadian businesses benefit from RMB hub

RELATED LINKS

http://advantagebc.ca/” target=’_blank’>http://advantagebc.ca/

Warren Buffett: Derivatives Are Still Weapons Of Mass Destruction And ‘Are Likely To Cause Big Trouble’

After all these years, the most famous investor in the world still believes that derivatives are financial weapons of mass destruction. And you know what? He is exactly right. The next great global financial collapse that so many are warning about is nearly upon us, and when it arrives derivatives are going to play a starring role. When many people hear the word “derivatives”, they tend to tune out because it is a word that sounds very complicated. And without a doubt, derivatives can be enormously complex. But what I try to do is to take complex subjects and break them down into simple terms. At their core, derivatives represent nothing more than a legalized form of gambling. A derivative is essentially a bet that something either will or will not happen in the future. Ultimately, someone will win money and someone will lose money. There arehundreds of trillions of dollars worth of these bets floating around out there, and one of these days this gigantic time bomb is going to go off and absolutely cripple the entire global financial system.

After all these years, the most famous investor in the world still believes that derivatives are financial weapons of mass destruction. And you know what? He is exactly right. The next great global financial collapse that so many are warning about is nearly upon us, and when it arrives derivatives are going to play a starring role. When many people hear the word “derivatives”, they tend to tune out because it is a word that sounds very complicated. And without a doubt, derivatives can be enormously complex. But what I try to do is to take complex subjects and break them down into simple terms. At their core, derivatives represent nothing more than a legalized form of gambling. A derivative is essentially a bet that something either will or will not happen in the future. Ultimately, someone will win money and someone will lose money. There arehundreds of trillions of dollars worth of these bets floating around out there, and one of these days this gigantic time bomb is going to go off and absolutely cripple the entire global financial system.The derivatives genie is now well out of the bottle, and these instruments will almost certainly multiply in variety and number until some event makes their toxicity clear. Central banks and governments have so

far found no effective way to control, or even monitor, the risks posed by these contracts. In my view, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

Thirteen years after describing derivatives as “weapons of mass destruction” Warren Buffett has reaffirmed his view that they pose a threat to the global economy and financial markets.In an interview with Chanticleer this week, Buffett said that “at some point they are likely to cause big trouble“.“Derivatives, lend themselves to huge amounts of speculation,” he said.

“The problem arises when there is a discontinuity in the market for some reason or another.“When the markets closed like it was for a few days after 9/11 or in World War I the market was closed for four or five months – anything that disrupts the continuity of the market when you have trillions of dollars of nominal amounts outstanding and no ability to settle up and who knows what happens when the market reopens,” he said.

Fast forward to the financial meltdown of 2008 and what do we see? America again was celebrating. The economy was booming. Everyone seemed to be getting wealthier, even though the warning signs were everywhere: too much borrowing, foolish investments, greedy banks, regulators asleep at the wheel, politicians eager to promote home-ownership for those who couldn’t afford it, and distinguished analysts openly predicting this could only end badly. And then, when Lehman Bros fell, the financial system froze and world economy almost collapsed. Why?The root cause wasn’t just the reckless lending and the excessive risk taking. The problem at the core was a lack of transparency. After Lehman’s collapse, no one could understand any particular bank’s risks from derivative trading and so no bank wanted to lend to or trade with any other bank. Because all the big banks’ had been involved to an unknown degree in risky derivative trading, no one could tell whether any particular financial institution might suddenly implode.

The 75 Trillion Dollar Shadow Banking System Is In Danger Of Collapsing

http://theeconomiccollapseblog.com/archives/the-75-trillion-dollar-shadow-banking-system-is-in-danger-of-collapsing” title=”Email” target=’_blank’>

http://theeconomiccollapseblog.com/archives/the-75-trillion-dollar-shadow-banking-system-is-in-danger-of-collapsing” title=”Email” target=’_blank’>

Keep an eye on the shadow banking system – it is about to be shaken to the core. According to the Financial Stability Board, the size of the global shadow banking system has reached an astounding 75 trillion dollars. It has approximately tripled in size since 2002. In the U.S. alone, the size of the shadow banking system is approximately 24 trillion dollars. At this point, shadow banking assets in the United States are even greater than those of conventional banks. These shadow banks are largely unregulated, but governments around the world have been extremely hesitant to crack down on them because these nonbank lenders have helped fuel economic growth. But in the end, we will all likely pay a very great price for allowing these exceedingly reckless financial institutions to run wild.

Keep an eye on the shadow banking system – it is about to be shaken to the core. According to the Financial Stability Board, the size of the global shadow banking system has reached an astounding 75 trillion dollars. It has approximately tripled in size since 2002. In the U.S. alone, the size of the shadow banking system is approximately 24 trillion dollars. At this point, shadow banking assets in the United States are even greater than those of conventional banks. These shadow banks are largely unregulated, but governments around the world have been extremely hesitant to crack down on them because these nonbank lenders have helped fuel economic growth. But in the end, we will all likely pay a very great price for allowing these exceedingly reckless financial institutions to run wild.The shadow banking system (or shadow financial system) is a network of financial institutions comprised of non-depository banks — e.g., investment banks, structured investment vehicles (SIVs), conduits, hedge funds, non-bank financial institutions and money market funds.How it works/Example:Shadow banking institutions generally serve as intermediaries between investors and borrowers, providing credit and capital for investors, institutional investors, and corporations, and profiting from fees and/or from the arbitrage in interest rates.Because shadow banking institutions don’t receive traditional deposits like a depository bank, they have escaped most regulatory limits and laws imposed on the traditional banking system. Members are able to operate without being subject to regulatory oversight for unregulated activities. An example of an unregulated activity is a credit default swap (CDS).

The current financial crisis has highlighted the growing importance of the “shadow banking system,” which grew out of the securitization of assets and the integration of banking with capital market developments. This trend has been most pronounced in the United States, but it has had a profound influence on the global financial system. In a market-based financial system, banking and capital market developments are inseparable: Funding conditions are closely tied to fluctuations in the leverage of market-based financial intermediaries. Growth in the balance sheets of these intermediaries provides a sense of the availability of credit, while contractions of their balance sheets have tended to precede the onset of financial crises. Securitization was intended as a way to transfer credit risk to those better able to absorb losses, but instead it increased the fragility of the entire financial system by allowing banks and other intermediaries to “leverage up” by buying one another’s securities.

Their growth had caused the man who is now China’s top securities regulator to label the off-balance-sheet products a “Ponzi scheme,” because banks have to sell more each month to pay off those that are maturing.

Mutual funds, hedge funds, and ETFs, are part of the “shadow banking system” where these modern “banks” are not required to maintain reserves or even emergency levels of cash. Since they in effect now are the market, a rush for liquidity on the part of the investing public, whether they be individuals in 401Ks or institutional pension funds and insurance companies, would find the “market” selling to itself with the Federal Reserve severely limited in its ability to provide assistance.

Long used to the inevitability of capital gains, investors and markets have not been tested during a stretch of time when prices go down and policymakers’ hands are tied to perform their historical function of buyer of last resort. It’s then that liquidity will be tested.And what might precipitate such a “run on the shadow banks”?1) A central bank mistake leading to lower bond prices and a stronger dollar.2) Greece, and if so, the inevitable aftermath of default/restructuring leading to additional concerns for Eurozone peripherals.3) China – “a riddle wrapped in a mystery, inside an enigma”. It is the “mystery meat” of economic sandwiches – you never know what’s in there. Credit has expanded more rapidly in recent years than any major economy in history, a sure warning sign.4) Emerging market crisis – dollar denominated debt/overinvestment/commodity orientation – take your pick of potential culprits.5) Geopolitical risks – too numerous to mention and too sensitive to print.6) A butterfly’s wing – chaos theory suggests that a small change in “non-linear systems” could result in large changes elsewhere. Call this kooky, but in a levered financial system, small changes can upset the status quo. Keep that butterfly net handy.Should that moment occur, a cold rather than a hot shower may be an investor’s reward and the view will be something less than “gorgeous”. So what to do? Hold an appropriate amount of cash so that panic selling for you is off the table.

Saudi Arabia Paying American Lobbyists To Spread Anti-Iran Propaganda

Submitted by Tyler Durden on 08/25/2015 – 21:50