MARKETS OVERNIGHT 8/24-25/15

25

Aug

MARKETS OVERNIGHT 8/24-25/15

Tweets:

Brent #oil falls below $45 for first time in six years http://bloom.bg/1U9qpVa

Chinese government said to stop support for the stock market http://bloom.bg/1NyoFGg

Analysis: Chinese economy still resilient, innovative despite currency, growth concerns http://xhne.ws/Io1Xx

@LivingZimbabwe: Nothing new frm the tired President . The same failed policies, recycling tired old out of touch deadwood in his cabinet.

@LivingZimbabwe refuse to take responsibility, blame everything on other people and insult everyone that comes to his mind.

@LivingZimbabwe Save us mate, whats the hype with Mugabe and the State of the Nation Address, he has one option RESIGN

10 officials from the Ministry of Lands and Rural Resettlement arrested for corruption ~ http://www.chronicle.co.zw/10-corrupt-land-officers-arrested/ …

Government going ahead with plans to revive Cotton Marketing Board to protect farmers ~ http://www.chronicle.co.zw/no-going-back-on-cmb-vp-mphoko/ …

#Business: Rand hits record low ~ http://www.chronicle.co.zw/rand-hits-record-low/ …

3 key numbers that will show where the stock market is headed http://money.us/1Jw5Twu

What really happened yesterday? Bloomberg breaks it down for you http://www.bloomberg.com/news/articles/2015-08-25/was-this-a-flash-crash-and-other-questions-about-monday-s-swoon …

China’s central bank pumps in another 150 bln yuan via reverse repo to ease liquidity strain http://en.people.cn/business/n/2015/0825/c90778-8941419.html …

#Russia now is destination for less than 2% of #Germany exports, ranking below #Sweden and #Hungary, says @OstAusschuss.

#ChinaMarkets Live – Shanghai crashes to end at 8-month low, Index falls under key 3,000 level at day’s end. #stocks http://ow.ly/RkitK

UK petition to arrest Netanyahu for #Gaza war crimes reaches over 80,000 signatures http://on.rt.com/6prb

IAEA says needs more money to implement Iran nuclear deal http://reut.rs/1MKrWAw

“All 15 central banks that raised interest rates since the 2008 financial crisis ended up cutting again.” http://bloom.bg/1IbGmDs

China’s central bank pumps in billions into financial system to ease liquidity strain http://xhne.ws/ev8Ej

This chart shows traders in the Australian market are expecting volatile weeks ahead http://www.businessinsider.com.au/chart-this-is-not-over-2015-8 …

China market fall has topped 1997 Asia Financial Crisis and 2001 Dotcom. Up next: 2008 Crisis. http://www.economist.com/blogs/graphicdetail/2015/08/daily-chart-9 …

China’s Ex-Vice Finance Minister Elected First #AIIB President http://sptnkne.ws/CXR

Shanghai Comp has closed lower by 7.6% today after falling by 8.5% yday.

Half of the 30 biggest emerging markets have fallen into bear territory, by @SriniSivabalan http://bloom.bg/1U9XEaY

BREAKING: China’s stock market down over 8% again — two large caps Sinopec and PetroChina both down 10%, w/ all listed brokerages down 10%

#Seoul shuts off #DMZ #propaganda broadcasts after deal with North Korea to end stand-off http://ow.ly/RkdaF

Is this market rally a ‘dead roo hop’? @mikejanda says don’t be too sure the worst has passed http://ab.co/1V6fMow #ASX #ASX200

Stop blaming China for #BlackMonday. China is the main victim. – The FED created the mess. I know it’s difficult to understand.

Jeb Bush: NSA Needs Broader Power, Urges Tech Firms to Cooperate http://themostimportantnews.com/?p=19544

Shanghai -8%

BHP MISSES — 86% drop in profit for world’s biggest miner – http://bit.ly/1WPhn3O

Will Black Monday roll into an even worse Tuesday? Chinese markets plunge further http://tgr.ph/1MQbosB

Shanghai Composite -7.8%, has lost 22% in just four days. State given up?

US to Deploy 3 Stealth #Bombers to Pacific http://sptnkne.ws/CYM #military (to be based in Guam and because of the N/S Korea scuffles)

Morning Note: 1. BHP profit drops 52%. 2. Fed hike?! #Team2016 anyone? 3. SHCOMP drops below 3000 points. Crushed.

Chinese economic research agencies are assuming yuan will weaken to 7 to the dollar by end of 2015 (-8% from today) http://www.bloomberg.com/news/articles/2015-08-25/china-agencies-said-to-assume-yuan-at-7-to-dollar-in-research-idqx3oae … (SEE ARTICLE BELOW)

BREAKING: Bye-bye! Shanghai benchmark index sinking nearly 7%, breaking psychologically important 3,000 points level

More volatility for Asian markets as shares in China, Japan slide http://on.mktw.net/1MKcrbR

DAX futures are suddenly down in pre-market. What a move!

Nikkei Futures have given up 1000 from session highs

There is a market crash in China and Japan this morning again but no.. @BloombergTV and @cnbc prefer to talk about France and South Africa.

China -7% Japan -3% As they keep saying that “Asian Markets are bouncing back!?!?”

Kazakhstan Tenge Falls 5.7% to 241.13 Per Dollar

Japanese Equities Resume Slump -1.3% as Yen Strengthens

Yesterday #BlackMonday selloff wiped $2.7 trillion from global equity markets.

European shares rally after Monday’s rout

Here we go again….

The FTSE 100 index has jumped by 102 points at the start of trading in the City, a gain of 1.7%, taking it back over the 600 mark.

Other European markets are also rallying, with France and Germany up 1.7% and Italy gaining 2%.

That recovers some, but not all, of yesterday’s rout which wiped around 4% off the main indixes.

And there are still fears that Europe’s fragile recovery will be knocked hard by China.

Augustin Eden of Accendo Markets explains:

Steep slides in equity markets and fears of a China-led slowdown in emerging economies are upending hopes in much of Europe that strong global growth and a weak euro would boost the region’s limp recovery.

Sell-off resumes as China worries drag on markets

The rout is gathering pace again.

The Shanghai Comp is down more than 6% while the Nikkei in Tokyo and the Hang Seng are also down in a wave of selling since the Chinese markets reopened after lunch.

One or two markets are proving immune to such negativity, namely Australia, South Korea and Taiwan

Updated at 4.02pm AEST

China’s Shanghai Composite now down 6%

After a volatile session, the main Asian markets are suffering a late selloff.

The Shanghai Composite index is now down by over 6%, with an hour’s trading to go.

That puts the index close to the 3,000 point mark, meaning it’s now down by 6.5% this year.

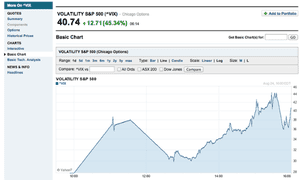

Having said that, the S&P VIX volatility index, otherwise known as the Fear Index, is heading north again – a bad sign.

As my colleague Graeme Wearden explained yesterday, “the VIX tracks the prices of options on the S&P 500, which are often used to hedge against potential losses. So a jump in the VIX shows that investors are getting scared…”

The S&P VIX index. Photograph: Yahoo

The S&P VIX index. Photograph: Yahoo

Chinese Agencies Have Begun to Assume Yuan at 7 to Dollar in Research

Some Chinese agencies involved in economic affairs have begun to assume in their research that the yuan will weaken to 7 to the dollar by the end of the year, said people familiar with the matter.

The research further factors in the yuan falling to 8 to the dollar by the end of 2016, according to the people, who asked not to be identified because the studies haven’t been made public. Those projections — which suggest a depreciation of more than 8 percent by Dec. 31 and about 20 percent by the end of 2016 — were adopted after the currency was devalued this month and compare with analysts’ forecasts for the yuan to reach 6.5 to the dollar by the end of this year.

While the rate used in the research isn’t a government target, it reflects the view that China may allow the yuan to fall further after a depreciation in which the currency was allowed to weaken by nearly three percent on Aug. 11 and 12. The yuan weakened for a second day in Shanghai, trading at 6.4135 against the U.S. dollar at 2:28 p.m. local time.

“It wouldn’t be totally unreasonable for China to allow a weakening like this,” said Zhou Hao, an economist at Commerzbank AG in Singapore, referring to the 7 level against the dollar at the end of this year. “A certain level of depreciation can be accepted according to China’s international payments situation, but it may bring unforeseeable pressure on foreign debt repayments and capital outflows.”

Reference Level

The rate used in the research constitutes reference levels used for economic assessments and projections, according to the people. The People’s Bank of China didn’t respond to a fax seeking comment.

A dollar-yuan rate of 7 would be a more than 8 percent depreciation from Tuesday’s level. At an Aug. 13 briefing on the yuan, PBOC Deputy Governor Yi Gang dismissed the idea that China would devalue the yuan by 10 percent to boost exports, calling it “nonsense.”

There is a 9 percent chance the yuan will be at or weaker than 7 per dollar at the end of this year, according to Bloomberg calculations based on implied volatility levels from the options market. A level of 8 or weaker a year from now is given less than a 5 percent chance.

The central bank on Tuesday added the most funds to the financial system in open-market operations in six months and sold the cheapest treasury deposits in five years as efforts to prop up the yuan strained the supply of cash.

Major banks have been seen selling dollars toward the close of onshore trading in Shanghai on most days since the surprise yuan devaluation on Aug. 11. The intervention removes funds from the financial system and risks driving borrowing costs higher unless the monetary authority releases additional cash. China’s foreign-exchange reserves will drop by some $40 billion a month for the rest of this year, according to the median of 28 estimates in a Bloomberg survey this month.

Chinese shares slumped, extending the steepest four-day rout since 1996, on concern the government is paring back market support. The Shanghai Composite Index was 6.6 percent lower at 2,998.75 at 2:10 p.m. local time.

US dollar plummets as rate-hike expectation dims

(Xinhua)Updated: 2015-08-25 09:20

NEW YORK – The US dollar dropped against most major currencies on Monday as investorslowered their expectation for an interest-rate hike this year following a rout in global equitymarkets.

US stocks slumped after opening on Monday, with the Dow Jones Industrial Average slidingbelow 16,000 for the first time since February 2014.

Meanwhile, the Chinese stock markets had their worst day in eight years with the benchmarkShanghai Composite Index tumbling 8.49 percent to close at 3,209.91 points.

European equities also dived on Monday following the steep decline in the previous session, asthe Stoxx Europe 600 was down over 6 percent and Germany’s DAX dropped 4 percent.

Analysts said the weak economic data from China had fueled worries that a drop-off in Chinesegrowth could cause a global slowdown, thus casting uncertainties on the timing of the FederalReserve raising interest rates.

They noted that higher rates would increase borrowing costs for companies and consumers,causing possible damage to the world economy.

The dollar index, which measures the greenback against six major peers, was down 1.71 percentat 93.386 in late trading.

In late New York trading, the euro rose to 1.1591 dollars from 1.1359 dollars in the previoussession, and the British pound climbed to 1.5773 dollars from 1.5703 US dollars in the previoussession. The Australian dollar inched down to 0.7184 dollar from 0.7329 dollar.

The US dollar bought 118.62 Japanese yen, lower than 122.06 yen of the previous session. Thegreenback dived to 0.9336 Swiss franc from 0.9486 Swiss franc, and surged to 1.3241Canadian dollars from 1.3170 Canadian dollars.

I like the message in this article!!!

China Strong Enough to Weather Stock Support End, Paper Says

China should wind down its stock market support program even if prices continue to fall, according to a commentary in a state-run official economic daily.

The front-page remarks in the Economic Information Daily sought Tuesday to reassure investors the Chinese economy wasn’t “that bad” and argued that disasterslike the Asian financial crisis or the sub-prime mortgage debacle wouldn’t repeat. They came as stocks extended their steepest rout since 2007 on concern the government is paring back support for the market.

The writer, identified as Xu Gao, said the government has been addressing its problems with local government debt and the global economic situation wasn’t as fragile as it was two decades ago.

Chinese authorities regularly use official media to send messages, and their commentaries generally reflect the thinking of Communist Party elites.

“The global stock plunge was more likely caused by emotions rather than fundamentals,” the commentary said in the paper owned by the official Xinhua News Agency. “It’s not good for the recovery of the economy to bring back the focus of quantitative easing to the stock market.”

The Shanghai Composite Index fell 4.3 percent to 3,071.061 at 12:28 p.m. local time, heading for the lowest close in eight months. The gauge plunged 8.5 percent Monday, following last week’s 12 percent decline.

In another sign the government could start to pull back from underpinning the market, Caixin reported the China Securities Regulatory Commission has displayed indifference to the latest stock plunge. That may be a sign of maturity in the way it supervises the market, Caixin said, citing an unidentified person close to the regulator.

No Overtime

The CSRC didn’t order relevant departments to work overtime after Monday’s declines as they did after other recent market drops, Caixin added.

Concern over the health of the Chinese economy has contributed to the most unsettled period in global markets since the financial crisis, with trillions of dollars wiped off the value of equities and commodities.

“We shouldn’t lose confidence in the economic growth prospects of China and the globe,” the Economic Information Daily commentary said.

Other state media also urged investors not to panic, with the China Securities Journal saying weakness in markets around the globe — including in the U.S. — has affected Chinese shares. Investors should balance their positions and wait for the market to calm down, it said.

“It’s NOT a correction, it’s a COLLAPSE”. Cash is king right now. Do not listen to Tony’s or any other “expert” in medialand; stay out of the markets, it is not your time yet. (Charts wouldn’t copy into this email – go to link below for visuals)

Black Monday: Stock market meltdown wipes billions off global indices as China fears decimate investors

“Dealers don’t know what to do with themselves”: Wall Street engulfed in selling bloodbath as billions are wiped from global indices

|

|

|

|

|

|

Futures trading was suspended in the US as panic gripped investors Photo: 2015 Getty Images

An unprecedented collapse in Chinese shares sent tremors through financial markets on Monday, triggering the ugliest day of global trading since the depths of the financial crisis eight years ago.

Billions were wiped off indices across the world in a day of frenetic selling which saw the Shanghai composite suffer an 8.5pc decline, its worst one-day performance since 2007.

The mass panic, dubbed “Black Monday” by China’s official state news agency, was driven by investors’ dashed hopes that Beijing would inject a fresh round of stimulus into its economy at the weekend.

China’s benchmark index has now lost all of its yearly gains after a relentless ascent that saw its valuation rise to record levels earlier this year.

Asian markets crashed on the news, with Japan’s Nikkei closing down 4.5pc and entering official “correction” territory. Hong Kong’s Hang Seng sank 5.2pc, its steepest sell-off in 30 years.

Emerging markets, most exposed to a waning Chinese economy, saw their currencies continue an abysmal summer rout. Russia’s rouble fell to an all-time low of 70.74 to the dollar, despite desperate attempts by the Kremlin to prop up its value.

“Stock markets are falling apart at the seams”

Contagion quickly spread west, decimating European indices, which all suffered record post-crisis losses. The FTSE 100 dropped 4.7pc, wiping £74bn off its market capitalisation and capping its worst one-day performance since March 2009.

The index staged a minor rebound, having lost more than £55bn in the first two hours of morning trading. Britain’s benchmark index has now collapsed by 17pc since hitting a high of 7,104 in April and is slipping towards official bear market territory, defined as a 20pc decline from its peak.

Europe’s FTSE EuroFirst300 stocks endured a 5.6pc loss that erased €450bn from the continent’s biggest companies. Italian stocks led the falls, down 6pc, while France’s CAC 40 suffered a 5.4pc decline, closing at 4383.46. Germany’s DAX also entered correction territory, bleeding 4.7pc.

A pedestrian walks past an electronic stock board displaying the Shanghai Composite Index, outside a securities firm in Tokyo Photo: Tomohiro Ohsumi/Bloomberg

A pedestrian walks past an electronic stock board displaying the Shanghai Composite Index, outside a securities firm in Tokyo Photo: Tomohiro Ohsumi/Bloomberg“Stock markets are falling apart at the seams,” said Jasper Lawler at CMC Markets.

“There was one point today when there just seemed to be no buyers and markets just went into freefall.”

Fears soon engulfed Wall Street, where the Dow Jones lost 1,000 points minutes after the opening bell. Pre-market futures trading in the Dow and the S&P 500 had to be suspended as investors became embroiled in a manic sell-off.

In a day of wild swings, the S&P500 was the biggest faller, closing -3.82pc and officially entering correction trading for the first time this year. It was followed by the Dow which traded in the red by -3.56pc.

- Global currency wars: China’s devaluation is a peace offering to the world

- The end of the bull market will make us all poorer

“Dealers don’t know what to do with themselves because the market moves are so enormous and erratic, and their levels of fear are outweighing their greed,” said David Madden at IG.

The VIX “fear index” – a measure of market volatility – rocketed to its highest level since November 2011.

The risk-off sentiment saw a rally in US treasury bonds, where yields dipped below 2pc for the first time since April as money flocked into perceived “safe havens”. The dollar, which has been on a sustained bull run ahead of an expected interest rate rise from the Federal Reserve, collapsed to a seven-month low against the euro.

Investors have been spooked by a cocktail of worries over China’s “hard-landing”, declining commodity prices and a premature rate hike from the Federal Reserve.

Larry Summers, a former US Treasury Secretary and one-time candidate to take over the top job at the central bank, said the events had the hallmark of previous summer ruptures in the markets.

“As in August 1997, 1998, 2007 and 2008 we could be in the early stage of a very serious situation,” tweeted Mr Summers.

Markets have now slashed their probability of a September rate hike from the Fed to 24pc, from a peak of 50pc earlier this month. Analysts at Barclays shifted their forecast for the first tightening in eight years to March 2016.

The renewed mini sell-off in US equities late in trading was driven by comments from Federal Reserve policymaker Dennis Lockhart that a lift-off would still be on the cards this year. The hawkish Mr Lockhart said the picture had been complicated by falling oil prices, the yuan devaluation and shifts in the value of the US dollar. He added that any normalisation would be “gradual”.

“The collapse of the equity bubble tells us next to nothing about the state of China’s economy”

Mark Williams, Capital Economics

The rout was sparked by China’s surprise decision to weaken its currency on August 11, a move which has led to more than $5 trillion being erased from world stocks. But economists warned the relentless bout of selling was becoming dangerously divorced from economic reality in China.

“The collapse of the equity bubble tells us next to nothing about the state of China’s economy,” said Mark Williams, chief Asia economist at Capital Economics.

“In fact, recent data have been more positive than the headlines might suggest, with large parts of the economy still looking strong.”

Analysts now expect an interest rate cut to be imminent, as Beijing makes use of its considerable space to loosen policy through its benchmark interest rate (RRR), which currently stands at 18.5pc.

How Washington will try to rig the stock market

By John Crudele

August 24, 2015 | 8:48pm

Modal Trigger

World stock markets plunged on Monday after China’s main index sank 8.5 percent — its biggest drop since the early days of the global financial crisis.Photo: AP

How long will it be before Washington decides to rig the US stock market?

Well, it could have happened Monday around noon.

The US Treasury admitted that it had been in touch with “market participants.” Was that just a social call or was Treasury Secretary Jack Lew lining up his market manipulators?

The rig didn’t take, even though the Dow Jones industrial average went from a loss of more than 1,000 points to one-tenth that amount around lunchtime.

But by the end of the day, the Dow still lost an incredible 586.13 points, or 3.6 percent.

But just because the market manipulation didn’t work on Monday doesn’t mean Washington will stop trying.

The Chinese, as you may know, rigged their market earlier in August. Then Beijing said it wouldn’t do that anymore. But it did — and Chinese stocks collapsed anyway.

Stock markets in the US are plunging for a lot of reasons. The most obvious one is that stocks were priced too high because Wall Street thought they still had plenty of growth ahead of them and didn’t see an economically cooling China coming.

In other words, there was a bubble.

Other problems include a poor economy in the US, disappointing corporate earnings and stagnant revenues, a budding currency war, a Federal Reserve that’s lost and confused and the fact that we’d even think of making a guy like Donald Trump president.

I probably missed a couple of the catalysts for the latest bubble popping, but you get the idea.

Modal Trigger

A trader on the floor of the New York Stock Exchange reads his monitor on Monday.Photo: AFP/Getty Images

So back to my question: When will Washington try to rig the market?

When it does — and it will — the action won’t necessarily be as obvious as it was in China, or as it was on Monday. The Obama Administration isn’t going to admit to anything, just as President Bush and President Clinton never got their fingerprints on market manipulation.

Here’s how the manipulation will likely take place:

1) Washington will encourage companies to repurchase their own stock.

That’s what happened when the market fell apart in 2007-08. Corporate executives will be thrilled to do this, not out of their patriotic duty, but because they typically have a lot of their own wealth tied up in their company’s stock.

The problem is, wasting money on share repurchases means less spending on business expansion and hiring. This will hurt the economy.

2) Federal Reserve officials will soon come out and promise not to raise interest rates at their September meeting.

Cross their heart and hope to die.

The problem with this that people already don’t think the Fed will raise rates. In fact, as I’ve been saying, any rate hike this year will be a miracle, because the US economy is weakening and China has already caused the dollar to be stronger than Washington would like.

The Fed could also hint at another quantitative easing — and that was the hope on Wall Street on Monday. QE is the program whereby the Fed prints money to rig the bond market and keep interest rates low.

But if the Fed tried for QE4, it would seem incredibly desperate. And the Fed would also make a liar out of itself. The Fed has said repeatedly that it doesn’t worry about the stock market — so why would another QE be necessary?

QE has been useless in improving the economy, but it did help create the stock-market bubble. So Fed Chairwoman Janet Yellen might go for this option.

3) One of these mornings — or overnight — some mysterious buyer will suddenly start purchasing an abnormal amount of Standard & Poor’s 500 stock index futures.

So we get down to direct intervention — just like China did. Only Washington, with Wall Street as its co-conspirator, won’t be as sloppy as Beijing was.

That’ll get the stock market moving higher and everyone will pretend that the buyers are just ordinary people who suddenly think Wall Street is oversold.

Is that last solution my own personal conspiracy theory? Not at all. That’s the remedy devised in 1989 by a guy named Robert Heller, who at the time had just left the Federal Reserve Board.

Heller said the Fed should rig the stock market in times of emergency. And that’s what the Fed has been doing ever since — you just haven’t realized it.

Who says the Chinese couldn’t learn a thing or two from us?

So another stock market bubble bites the dust. Just like the last one, and the one before that and the one before that.

Inflated stock prices have become a tool of economic management. It’s a bad thing, but so is disease and the fact that CC Sabathia can’t throw 95 miles an hour anymore.

Stock-market bubbles are something we are going to have to live with until our elected officials and the appointed ones at the Fed fix the economy and stop trying to make people feel rich by causing assets to rise without justification.

I’ve been telling you the market was in a bubble. And I even mentioned a week or so ago — when the market was about 15 percent higher — that the bubble was popping.

If you got out of the market in time and intact, congratulations. If you didn’t, I suggest you call your broker — and any news organization that has been leading you astray — and ask for an apology.

Start with CNBC, the propaganda network of Wall Street. Commentators on CNBC will be screaming “buying opportunity” before too long.

You should switch off that station, as tens of thousands of others already have.

Sources tell me the Census Bureau is pinching pennies because it is afraid that it won’t have enough money to complete its August and September surveys.

Remember, Census is the government agency that saw fit to hire Dick Gregory earlier this year for some racist chit-chat. It is also the agency that is refusing to turn over a list of contracts that I’ve requested.

As I wrote back in May, Congress said it was going to audit Census because it didn’t know where all the Bureau’s money was going.

Sept. 30 is the end of the government’s fiscal year, so Census could be feeling financially pinched. And because of major reforms ordered by Congress — caused by my investigation — Census had to clean up its act this past year.

By doing its surveys correctly, Census could be incurring costs it didn’t expect when it was cheating and cutting corners.

Anyway, I asked Census and the Labor Department about the reports of money woes. Labor didn’t get back to me. Its worthless Current Population Survey, from which the unemployment rate is derived, would be affected if Census runs out of dough.

Census did respond, but said I needed to get in touch with the Office of Budget and Management to get my question answered. The way I figure it, if the reports weren’t true, Census simply would have refuted them.

There’s something else that is curious: Census also inadvertently put on the top of its e-mail response to me in capital letters: MAY NEED ATTENTION.

That, obviously, wasn’t intended for me. But yes, it does need attention.

Global currency wars: why China’s devaluation is a peace offering misunderstood by the world

Renminbi shift is not the opening salvo in a 1930s-style cycle of “competitive easing”

…”China’s devaluation was puny”, says Benjamin Cohen, professor of International Political Economy at the University of California.

“It is clear that overblown headlines about the renminbi’s “plunge” were woefully misleading. Had China really wanted to grab a bigger share of world exports, it is hard to imagine that its policymakers would have settled for such a modest adjustment,” says Cohen.

…Plenty of reasons have been proffered over China’s “true” motivations. Many have suggested the PBOC is playing a “smoke and mirrors” game to slowly engineer a more competitive yuan.

But the most plausible motive is also the most prosaic.

China has long sought official reserve currency status, as bestowed by the International Monetary Fund through its “special drawing rights” basket of currencies. The dollar, sterling, yen, and euro currently make up the SDR.

Liberalisation of the renminbi, so it can move towards a more market determined value, has long been a pre-requisite for its inclusion in the basket. In shifting from a currency peg to a managed float, Beijing took its first incremental steps towards becoming an official global reserve.

“Long-term thinking has landed China in some short-term difficulties”, says Joshua McCallum, head of fixed income economics at UBS global asset management.

“This is less a currency war than a currency peace offering” he says.

“If China wanted to gain a competitive advantage compared to where it is now, it would let the currency float and watch it drop by 10pc or more. But even if China did that, no self-respecting economist would call it a currency war if the markets were determining the price.”

More at:

CHINA

High expectations ahead of President Xi’s first US visit

President Xi Jinping’s first state visit to the United States in September could prove pivotal in changing the American people’s misconceptions about China

|

By Chen Weihua, Li Xiaokun

12:16AM BST 25 Aug 2015

More news, analysis and features at China Watch

President Xi Jinping’s first state visit to the United States in September could prove as pivotal in changing the American people’s perception of China’s global role as that of former leader Deng Xiaoping in 1979, a senior analyst has said.

Details of the visit were still to be released, but a United Nations timetable shows China’s head of state will give a speech at the UN General Assembly in New York on Sept 28 to mark its 70th anniversary.

Mr Xi, who took offce in March 2013, joined US President Barack Obama at Rancho Mirage in California during an unofficial visit to the US in June 2013.

Xi’s visit is as important as the US visit of Deng Xiaoping in 1979…

Xi’s visit is as important as the US visit of Deng Xiaoping in 1979…Yet analyst Liu Yawei has predicted that the upcoming visit could go a long way to addressing misconceptions about China among the American people.

“Since last year, the Americans have been losing faith in … what kind of superpower Beijing wants the country to become,” Mr Liu, director of the Carter Center’s China Program, told Chinese media recently.

“Xi’s visit is as important as the US visit of Deng Xiaoping in 1979, which changed American views on the Chinese overnight.”

Mr Deng’s nine-day tour, which included meeting President Jimmy Carter, was the fi rst by a Chinese leader after the founding of the People’s Republic of China.

Mr Liu said images of Deng kissing American children after a gala performance at the John F Kennedy Center for the Performing Arts in Washington moved many people, dissolving some fear over a communist threat.

It will be an important visit that will lay out the blueprint for relations and inject new impetus to the new model of major country relationship

Mr Xi’s previous visits to the US have already had a similar effect, he added, such as in 2012 when, as vice-president, he visited a family he had stayed with in Iowa during a trade mission in 1985.

On another level, Wang Fan, vice-president of China Foreign Affairs University, said the focus of the September visit could be to establish “understanding and designs” for a new type of major country relationship.

“New problems are emerging with the rise of China,” he said. “If we can reach some new understanding with the US on a strategic level, it will play an incomparable role in stabilising and developing relations.”

Leaders in both countries have reached a consensus that they “cannot benefit from each other’s problems, as we are interdependent”, and have tried to avoid confrontation, Mr Wang said.

The world’s two largest economies have witnessed closer ties in a wide spectrum of areas, from tourism to education.

However, strategic distrust remained, as manifested by differences in cybersecurity, China’s maritime territorial disputes with some neighbouring countries, the Obama administration’s pivot to Asia, as well as the US attitude towards China-proposed projects such as the Belt and Road Initiative and the Asia Infrastructure Investment Bank.

Cui Tiankai, the Chinese ambassador to the US, said the two presidents would take the opportunity in September to have candid and in-depth exchanges on major issues concerning bilateral relations and global peace and development, and would push for closer co-operation and more deliverables.

“It will be an important visit that will lay out the blueprint for relations and inject new impetus to the new model of major country relationship,” he said.

US officials also have high expectations, including US Secretary of State John Kerry who said it would help other nations to see China and the US work together.

Richard Bush, director of the Brookings Institution’s Center for East Asia Policy Studies, said the two leaders should avoid polite talk, but not critical issues, and suggested they produce a work plan for the next 18 months — Mr Obama’s remaining time in offoce — to focus on issues that require presidential leadership.

This article was originally produced and published by China Daily.

‘Double standards’ criticized

By ZHAO YINAN (china Daily)Updated: 2015-08-25 07:34l

China’s island reclamation is legal, reasonable and promotes the ‘public good’, experts say

|

|

This satellite image released on Wednesday shows the Fiery Cross Reef where the reclamation project has been completed. [Photo/Xinhua]

|

Experts said on Monday that China’s island reclamation in the South China Sea is well-founded, and the United States has adopted double standards on the issue.

The comments came in response to a US report on maritime security in the Asia-Pacific region that pointed fingers at China.

Ruan Zongze, vice-president of the China Institute of International Studies, said the building of facilities in the South China Sea is legal and reasonable, and it matches China’s responsibility and obligations in international affairs.

“The US has adopted double standards when it comes to the Nansha Islands in the South China Sea,” he said.

The US Department of Defense released a comprehensive strategy for maritime security in the Asia-Pacific region on Friday, including detailed descriptions of land reclamation in the South China Sea.

David Shear, US assistant secretary of defense for Asian and Pacific security affairs, said at a news conference on Friday that China’s expansion of land reclamation is one notable recent development in the area, but he admitted that China is not the only claimant to have conducted reclamation, and that land reclamation in the area is not new.

The Pentagon and China’s Ministry of National Defense are working to conclude an agreement on air-to-air encounters by the end of the year, Shear said.

Ni Feng, an expert on US studies at the Chinese Academy of Social Sciences, said China’s land reclamation is well-founded, and many of the facilities being built are for civilian use.

Ni said the US has neglected the fact that these facilities can greatly improve shipping safety in the area.

“China is building facilities mainly for the public good,” Ni said. The work includes lighthouse facilities, a meteorological observatory station and a maritime scientific research center, as well as search and rescue facilities for maritime emergencies, and medical and first aid facilities.

The construction of two lighthouses on Huayang Reef and Chigua Reef will help ensure shipping safety in the South China Sea, an area with many dangerous reefs, he said.

“The lives and property of fishermen are at risk because of the tough environment in the area. In addition, China will be able to provide more precise data on meteorological observation and sea measurement after the construction is completed,” he said.

The data, he said, are much needed at sea, and China is considering collaborating with other countries in maritime search, as well as opening up part of the facilities to international users.

China announced that it had completed land reclamation at the end of June.

Accusations of Chinese hacking are a US power play, experts say

By Zhao Shengnan (China Daily)Updated: 2015-08-13 07:51

Washington has launched a war of words over cybersecurity against China before President Xi Jinping’s US trip next month, a move that analysts say attempts to set the agenda for the state visit and put pressure on Beijing.

During a CBS Evening News television interview on Tuesday, US Secretary of State John Kerry accused China and Russia of “very likely” reading his e-mails.

Cyberattacks have been a topic of ongoing discussions with China and will be so again when US President Barack Obama hosts Xi in Washington in September, the top US diplomat said.

Kerry’s allegation followed an NBC report that claimed Chinese “cyberspies” have accessed the private e-mails of “many” top Obama administration officials since at least April 2010.

Zhu Haiquan, spokesman for the Chinese embassy in Washington, dismissed the NBC report.

He told Chinese media on Monday that China is a major victim of cyberattacks, and that the Chinese government firmly opposes all forms of cyberspying.

Fighting cross-border cyberattacks requires international cooperation, while “groundless accusations and microphone diplomacy won’t resolve any problems but only make things worse”, Zhu said.

Li Haidong, a professor of US studies at China Foreign Affairs University, said Washington is trying to inflame the issue through a series of accusations against China as a means of setting the agenda for Xi’s upcoming visit to the US.

“Washington often stands against China over issues like cybersecurity and the South China Sea, as it believes that China’s diplomacy and growing economic clout challenge US global leadership,” Li said.

Ni Feng, an expert on US studies at the Chinese Academy of Social Sciences, said that US cybertechnologies are far more advanced than China’s, and that the US business sector is a main force behind the US government’s pressing China.

Financial Times reported in July that the FBI has labeled China “the most dominant threat” to US companies and believes Beijing was the main culprit behind a sharp increase in economic espionage cases its agents were investigating.

Ni said the two sides haven’t found a solution to issues such as cybersecurity, and previous dialogues over the topic stalled after the US indicted five Chinese military officers last year on allegations of cybertheft.

But he added that Xi’s visit is expected to go smoothly and hardly be affected by the accusations – a measure that the US often uses to take the initiative before a high-level visit.

The 12th CAEXPO in Nanning, China in September

2015-07-30

The Best Platform for Building the “Belt & Road Initiative”

|

|

China’s Information Office of the State Council holds a press conference for the 12th China-ASEAN Expo on July 29 in Beijing. [Photo/CAEXPO Secretariat]

|

To facilitate in building the Silk Road Economic Belt and the 21st Century Maritime Silk Road, a grand event, the 12th China-ASEAN Expo, will soon take place on September 18th through 21st in Nanning, China.

The news came from a press conference held by the Information Office of the State Council in Beijing on July 29, attended by Madam Gao Yan, vice minister of commerce of China, Mr. Yu Ping, vice chairman of the China Council for the Promotion of International Trade and Mr. Zhang Xiaoqin, vice governor of Guangxi Zhuang autonomous region, the permanent host province of the CAEXPO, as well as 54 journalists of 35 media outlets from the Chinese Mainland, China’s Hong Kong, Macao and Taiwan, Vietnam, Korea, and other countries.

Cooperation between ASEAN and China maintains fast growth, and the CAEXPO is playing an important role in this regard. According to Vice Minister Gao Yan, as the China-ASEAN FTA moves forward, China and ASEAN countries are strengthening political trust, speeding up bilateral trade and integrating their economies for common development. Until the end of 2014, bilateral investment exceeded US$130 billion. China became the largest trading partner for ASEAN, and ASEAN became the third largest trading partner of China. Reciprocal cooperation between both sides is deepening, and a number of cooperation projects have been launched in electric power, bridges, agriculture and manufacturing. Madam Gao said the CAEXPO will deliver fruitful outcomes and become a model for cooperation.

The 12th CAEXPO will invest more effort in the Belt and Road Initiative. Mr. Zhang Xiaoqin said that this year marks a crucial stage for building the Initiative and the China-ASEAN Maritime Cooperation Year as well. With that background, the 12th CAEXPO will have new highlights as follows: first, it will have the theme “building the 21st Century Maritime Silk Road, Creating a New Blueprint for Maritime Cooperation” and arrange high-end activities to promote friendly exchanges and economic cooperation. Second, it will bring about more opportunities for China and ASEAN countries to improve the China-ASEAN FTA and increase cooperation in trade and finance. It will set up the first International Industrial Capacity Cooperation Zone and organize the China-ASEAN Forum on Infrastructure Construction and International Capacity Cooperation. Third, it will explore the international market by inviting Korea and more countries along the Belt and Road to visit the event. Other supporting organizations, the World Trade Organization (WTO) and the International Trade Center (ITC) will arrange the Symposium on Roles of Trade Facilitation on Regional Integration of Asia & Commemoration of the 20th Anniversary of the WTO during the 12th CAEXPO.

Preparations for the 12th CAEXPO are in full swing. Chinese and ASEAN companies show great enthusiasm for the event, with many applications for booths. Apart from China and ASEAN countries, the US, Canada, Germany, France, Japan, Korea, India, Australia, Hungary, Turkey, and other countries from South America and Middle East will participate as trade visitors. Cities of Charm of China and the 10 ASEAN countries have been decided. Thailand, the Country of Honor for the 12th CAEXPO, will organize an inaugural ceremony for its national pavilion, a national promotion conference, roundtable talks between its visiting leader and entrepreneurs, and other activities throughout the fair period.

China-ASEAN trade negotiations to be completed by year-end

By Zhong Nan (China Daily)

2015-07-30

Negotiations to upgrade the China-ASEAN Free Trade Agreement are expected to be concluded by the end of this year, Vice-Minister of Commerce Gao Yan said on Wednesday.

Gao said China is negotiating finer details on services and goods trading, as well as investment and technology collaboration with 10 members of the Association of Southeast Asian Nations.

Three rounds of meetings have been held since the various parties involved began formal negotiations in August 2014, said sources.

“China will fully tap the business potential, and expand two-way investment, in major sectors involved in the Belt and Road Initiative, including big-ticket projects involving global production, industrial parks and other cross-border projects,” Gao told a news briefing in Beijing.

The Silk Road Economic Belt and the 21st Century Maritime Silk Road initiatives were proposed by President Xi Jinping in 2013, with the purpose of rejuvenating the two ancient trading routes and further opening up markets for Chinese companies.

Bilateral trade between China and ASEAN rose by 1.6 percent year-on-year to $224.38 billion in the first half of this year.

Trade with ASEAN accounted for about 12 percent of China’s total foreign trade, and the country is now the region’s largest trading partner.

ASEAN is China’s third-biggest trading partner, with bilateral trade between the two worth $480.1 billion in 2014, up 8.23 percent from a year earlier.

The region hopes to achieve bilateral trade with China worth $500 billion by the end of this year and $1 trillion by 2020, with two-way investment levels of $150 billion by 2020.

Gao said talks on the planned Regional Comprehensive Economic Partnership, or RCEP, are also making headway, with China and ASEAN members reaching a breakthrough in seven areas including intellectual property protection, legal mechanism and competition policies.

Yu Ping, vice-president of China Council for the Promotion of International Trade, said ASEAN countries remain major destinations for Chinese companies.

China has built a number of major bridges, ports, roads and power stations, and cooperated on other large-scale infrastructure projects within ASEAN, such as the Suramadu Bridge and the Hydropower Plant in Bandung, in Indonesia’s West Java, the Myitsone Dam project in Myanmar, and the China-Laos and China-Vietnam Cross-border Economic Cooperation Zones.

“These projects have been critical in improving local infrastructure construction and boosting the economic growth of the countries concerned,” Yu said.

“China will continue with efforts to develop the Asian Infrastructure Investment Bank and participate more actively in infrastructure construction in ASEAN countries,” he said.

Two-way investment between China and ASEAN exceeded $130 billion by the end of 2014, over $90 billion of which came from ASEAN countries into China.

In an effort to compete with China’s growing economic influence, trade ministers from 12 countries including the United States, Canada, Japan, Australia and Chile are currently gathering in Hawaii until July 31 to finalize the Trans-Pacific Partnership.

The treaty is expected to compete with the China-ASEAN Free Trade Agreement and the RCEP.