So Long September: Bond Traders Defer Their Date With the Fed

20

Aug

So Long September: Bond Traders Defer Their Date With the Fed

So much for September.

Traders gearing up for the Federal Reserve to raise interest-rates next month reversed course Wednesday after minutes from the central bank’s July meeting showed policy makers were still waffling on whether the economy is strong enough to warrant higher borrowing costs.

That’s far short of the confidence they expected to see from a central bank supposedly just weeks away from what would be the first increase in almost a decade.

The probability that futures traders assign to a rate boost next month slid to 36 percent, the lowest since July, from about 50 percent earlier in the day. The levels assume that the Fed’s target will average 0.375 percent after the first move. The chance of an increase at or before the Fed’s December meeting dropped as well, to 65 percent from 73 percent Tuesday.

Declining energy prices and a strengthening dollar have weighed on bond-market inflation forecasts. So the news that officials had discussed persistently low inflation led traders to exit bets that the central bank was set to start raising interest rates. Before Wednesday, investors were betting that long-term Treasuries, which are sensitive to inflation, would outperform shorter maturities, which are more vulnerable to changes in Fed policy.

“Their stance on inflation has changed,” said George Goncalves, head of interest-rate strategy in New York at Nomura Holdings Inc., one of 22 primary dealers that trade with the Fed. “It’s starting to feel like they’re not going to go in September.”

No Guarantee

With the reversal of those bets, the premium that investors demand to own 30-year Treasuries instead of two-year notes swelled to the widest since Aug. 12.

“Those minutes did not guarantee a September rate hike, and some people were hoping that it would,” said Charles Comiskey, head of Treasury trading in New York at Bank of Nova Scotia, another primary dealer.

Traders aren’t completely ruling out a September increase. But Neil Bouhan, an interest-rate strategist with BMO Capital Markets, said it’s notable that the meeting happened before China’s devaluation of its currency this month and the deepening slump in crude prices, both of which have depressed inflation expectations. The Fed’s favored market inflation measure has dropped to 1.91 percent from 2.05 percent between July 29 and the release of the minutes.

The minutes “seem to suggest that if the meeting were today, the FOMC would be uncomfortable with the current conditions, which is how the market took this,” Bouhan, who’s based in Chicago, said in a report.

World’s Biggest Wealth Fund Tackles New Era as Cash Flows Dry Up

The spigots are being turned off for the world’s biggest wealth fund.

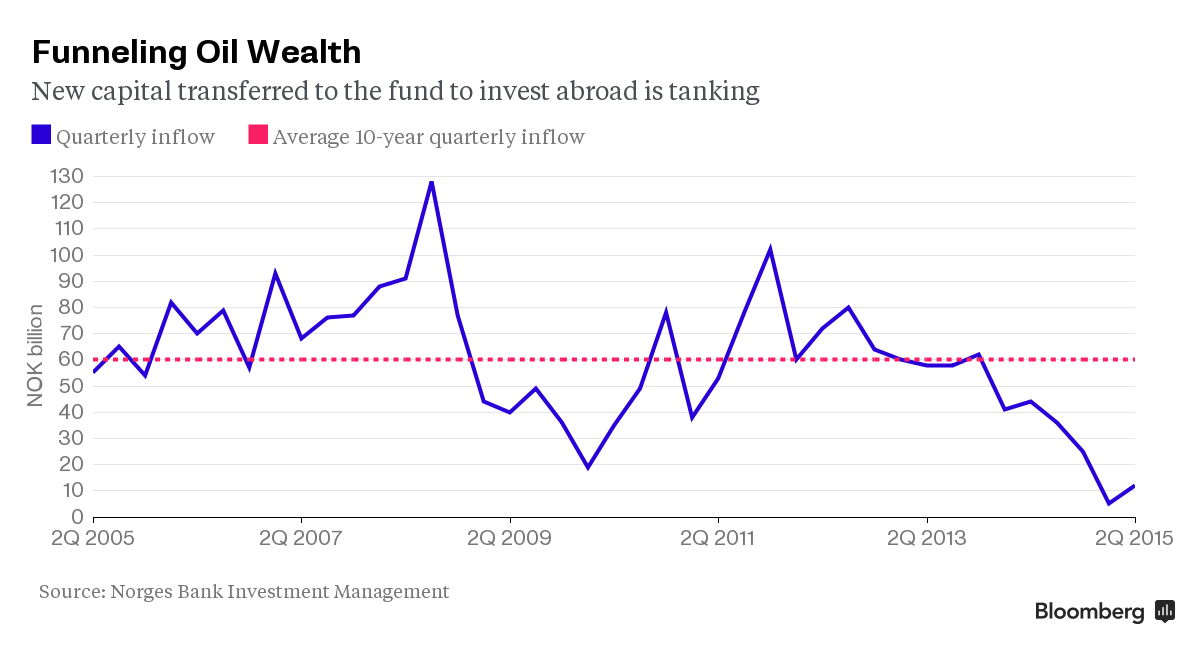

With crude below $50, the $870 billion fund has seen a precipitous drop in cash injections from Norway’s government. It received just 12 billion kroner ($1.4 billion) in the second quarter and 5 billion kroner in the first three months of 2015, compared with a quarterly average of 60 billion kroner over the past 10 years.

The sudden slowdown creates new risks for Norway’s fund, which since its inception in 1998 has relied on a steady cash flow to seek out new markets and strategies to increase returns. A retrenchment could have a broad impact on investors across the globe, since the fund owns about 2.4 percent of European stocks and last year emerged as the second-largest foreign buyer of U.S. real estate.

We still have a net positive inflow, although it’s very small these days,” Yngve Slyngstad, head of the fund, said in an interview in Oslo on Wednesday. While it won’t immediately change its strategy, the fund won’t have “the same amount of cash to reinvest,” he said.

The fund has typically used new cash to make large changes in its portfolio, such as when it went into real estate or increased its stake in emerging markets at the expense of Europe. The fund is dealing with smaller capital injections as it targets adding infrastructure to its portfolio of approved asset classes. It also wants to raise its allocation to real estate.

Strategy Shifts

The fund is also contending with a government that’s taking a larger share of the nation’s oil wealth to pad its budget as the oil slowdown has pushed up unemployment. The government in May predicted it would deposit 42 billion kroner into the fund for all of this year and estimated a 27 percent decline in oil income to 252 billion kroner. Oil was almost $20 higher back then.

According to Slyngstad, the decline in inflows has already hampered the fund’s shift away from Europe. The government in 2012 approved a plan to reduce holdings in Europe to 41 percent from 54 percent of the total portfolio as the region’s debt crisis raged.

“The big picture is that we will see a bigger relative risk and somewhat larger implementation costs during strategy changes now,” Slyngstad said.

The fund posted a loss of 73 billion kroner in the second quarter, the first decline in three years, dragged down by falling global bond and stock markets.Capital Transfers decline

Emerging markets

Emerging-Market Rout Strains Pegs as Tenge Shifts to Free Float

Kazakhstan relinquished control of its exchange rate in the latest sign emerging nations will stop defending their currencies after China roiled global markets by devaluing the yuan.

The central Asian nation, which counts Russia and China as its top trading partners, said it was switching to a free float, triggering a 23 percent slide in the tenge to a record 257.21 per dollar. Following the shock yuan devaluation last week, a gauge of 20 developing-nation exchange rates capped its longest slump since 2000, and losses continued this week as Vietnam devalued the dong and currencies from Russia to Turkey fell at least 3 percent.

“The appearance of China weakening its exchange rate to boost growth has added urgency for policymakers elsewhere to do what they can to grab more export revenue,” Koon Chow, a strategist at Union Bancaire Privee in London, said by e-mail. “It was probably no small thing that Russia and China are also big trading partners of Kazakhstan.”

Kazakhstan is central Asia’s biggest crude exporter and the country’s raw material producers have suffered since Russia stopped managing the ruble last November. In addition to the 55 percent slide in oil in the past year, the yuan move elevated pressure on the nation’s peg by forcing countries that rely on Russia and China for trade to seek ways to stay competitive.

Reconsidering fixed exchange rates is becoming more urgent also as the Federal Reserve moves closer to raising interest rates for the first time since 2006, which has throttled demand for emerging-market assets.

Not Competitive

Kazakhstan will pursue an inflation-targeting monetary policy, Prime Minister Karim Massimov told a government meeting in Astana. The central bank isn’t targeting a particular level for the currency, central bank Governor Kairat Kelimbetov said, adding that there will only be intervention if stability is threatened.

The ruble has slumped 46 percent in the past 12 months, versus a 7.6 percent weakening for the tenge before today’s switch. Kazakh business association Atameken and the chief executive officer of ArcelorMittal’s local unit were among business leaders complaining that the price differential had diminished the competitiveness of locally made products from steel to grains and coal.

The “move follows a huge loss of competitiveness, as key trade partner Russia has allowed the ruble to depreciate significantly as commodity prices slumped,” Tom Levinson, the chief foreign-exchange and rates strategist at Sberbank CIB in Moscow, said by e-mail. The yuan’s depreciation “may be an additional factor,” he said.

More Weakness

The tenge may have further to fall since it still hasn’t caught up with the ruble, according to Citigroup Inc. BMI Research on Wednesday cited Tajikistan and Kyrgyzstan as most vulnerable to a weakening of the Kazakh currency after the country let the tenge drop 4.5 percent.

The currency could drop to 267 tenge per dollar, Citi economist Ivan Tchakarov said in a note. Sberbank’s Levinson saw a retreat to 275.

Kazakhstan, the world’s 18th largest producer of petroleum and other liquids, must adjust to living with a crude price of $30 to $40 per barrel, president Nursultan Nazarbayev said at meeting with state officials on Wednesday. Brent oil has plunged 59 percent from its 2014 high and is now trading at $46.91 per barrel in London.

“Kazakhstan like a number of other emerging countries, are trying to remain competitive at a time when the dollar is strengthening,” said Gary Dugan, chief investment officer for private banking at National Bank of Abu Dhabi PJSC.

China

Currencies lose firepower as an effective trade weapon

Getty Images

When China’s central bank last week triggered the two biggest single-day falls in the renminbi since the 1990s, plenty of people were keen to proclaim a resumption of the “currency wars” that have been a feature of the global economy since the 2008 financial crisis.

But if Beijing’s move prompted a predictable political response from veteran currency warriors in Washington and other capitals, it ignored what many trade economists see as an increasingly well-documented fact — currencies are not the trade weapon they once were.

In a new study of 46 countries including China, economists at the World Bank found that currency devaluations are these days only half as effective a tool for boosting exports as they were in the mid 1990s.

Moreover, the World Bank economists found the more that countries became integrated into the global economy — as China has done in spectacular style since the 1990s — the less the effect was likely to be of any currency changes on their exports.

For countries such as China that weaken their currencies to seek competitive advantage in global trade, there is a “distinction between the perception of the impact of a depreciation and the actual impact a depreciation can have”, says Michele Ruta, one of the study’s authors.

The reality today, he says, is that years of data show the impact is likely to be much less than it used to be.

There are a number of reasons for that. But the biggest, say Mr Ruta and his colleagues, is the advent of global supply chains over the past two decades and the reality that many products today are agglomerations of parts made in many different countries

The result is a much more complex calculus for many economies such as China’s and products that have become necessities of modern life.

More from the Financial Times:

Renminbi shift challenges global markets

China warns of fresh renminbi volatility

A currency skirmish that was not made in China

China warns of fresh renminbi volatility

A currency skirmish that was not made in China

Weaker currencies do still lower the cost and therefore raise the international competitiveness of many goods exports while increasing the cost of imports.

For something as simple as a bottle of Australian shiraz squeezed from grapes grown on Margaret River vines, that reality still holds and matters. A weak Australian dollar will lower the cost of an exported bottle and make it more attractive to offshore consumers. It will also increase the price of imports into Australia of French or Chilean rivals, providing another boost to the local industry.

But for more complex products, like many of the electronic items assembled in China, the real impact is far more difficult to calculate.

In the case of a smartphone, for example, the screen may have been imported from Japan and the main chip from South Korea, while other parts are sourced in southeast Asia, Europe and even the US. So even as a weaker renminbi in theory lowers the price internationally of the finished product it also raises the cost of imported parts.

For that reason trade economists have increasingly begun to look at who gains the real “value-added” profits from products. Wherever you may buy an iPhone designed in California and assembled in China from parts from all over the world, most of the profits go to Apple not to Foxconn, the Taiwanese assembler or its workers in mainland China.

However, despite the shift in the global economy, in the case of China there is one reason why its exporters may gain more from a weaker currency than they once would have.

China’s import intensity — how much of exports were made up of imported parts — has fallen dramatically in many categories over the past decade. China has been expanding its own homegrown supply chains, something trade economists have cited as one reason for slowing growth in global trade in recent years.

<p>Did China&#039;s yuan devaluation spark a currency war?</p> <p>Wayne Gordon, commodities and FX strategist at UBS Wealth Management and David Mann, chief economist, Asia at Standard Chartered, discuss whether China&#039;s move to devalue the yuan added to fears of a currency war.</p>

But beyond China the reality is that even big devaluations have done little to help exports.

In a note to clients this week, Marc Chandler, global head of currency strategy for Brown Brothers Harriman, pointed out that the Japanese yen had fallen more than 17 per cent against the dollar in the past year and yet Japan’s exports in the three months to June posted the biggest quarterly decline in five years.

Similar patterns hold true in South Korea, Taiwan and even Germany, Mr Chandler says.

Taken together they point to a bigger malaise in the global economy, one that is unlikely to be overcome by any currency shifts.

“The key message that a lot of people miss is that the best thing for US exports, the best thing for Chinese exports, the best thing for European exports is not weakening currencies, it is stronger global demand,” he says.

|

Farewell to FX arms? Currencies lose trade firepower

Trade economists believe currencies are not the trade weapon they once were, the FT reports.

|

|||||||

|

Preview by Yahoo

|

|||||||

Baffled by China’s late-day swings? Read this

Chinese stocks went on a rollercoaster ride over the past two days, with the action usually gathering speed and magnitude in the final hour of trading, leaving investors struggling to keep up.

On Tuesday the Shanghai Composite index came under sudden heavy selling an hour before the market close at 3pm local time. In the last hour of trading, the benchmark index more than doubled losses to close down 6.1 percent, chalking up its biggest one-day fall since July 27.

The next day, after being deep in negative territory for most of the session, the Shanghai bourse staged a late-day turnaround to finish 1.2 percent higher. Earlier in the day, the key stock index plunged as much as 5 percent to an intra-day low of 3,563.1.

The extreme fluctuations are certainly not a new phenomenon; they were common fixtures during the bear market rout in mid-June, but had tapered following the government’s unprecedented rescue package last month. But this week’s dramatic moves were less well-flagged.

“With a lack of news, the mystery of Tuesday’s [fall] was baffling. Wednesday’s moves were more predictable as [Tuesday’s] plunge in share prices triggered a series of knock-on effects,” Nicholas Teo, a market analyst at CMC Markets, told CNBC by phone.

Experts say there are a couple of factors that could cause the afternoon gyrations.

1. Fragile market sentiment

Though the stock market has somewhat stabilized after a slew of official measures to arrest a sharp correction in June and July, investor sentiment remains fragile.

This has made mainland investors – retail traders make up around 80 percent of the Chinese market – susceptible to acting on rumors and misinterpreting market developments, according to IG’s market strategist Bernard Aw, thereby sparking “sudden bouts of substantial slides” in equity markets.

Some market watchers have attributed Tuesday’s whopping 6.1 percent slide to traders paring back their bets on support for the stock market, after the China Securities Finance Corporation (CSFC) said Friday it would not intervene further in the market unless there was unusual volatility and systemic risk. Aw thinks that investors may have overreacted to the comments.

“Nervous sentiment over the prospect of a further slowdown in growth is high. On top of that, you also see investors worrying over the withdrawal of support measures but [these worries] are overblown. Because the government isn’t going to withdraw all at one go,” Aw said. “So it seems that market participants were once again unduly misinterpreting the news.”

<p>Behind China&#039;s turbulent stock markets</p> <p>Volatility in China&#039;s stock market is inevitable following recent government intervention, says independent analyst Fraser Howie.</p>

2. Afternoon margin calls

The exact timing of margin calls may vary but it is common practice for brokerages to impose two margin calls on their clients; the first one in the morning session based on overnight moves in offshore markets and the second call in the afternoon session, said to be around 2pm in China, based on the day’s trading.

Margin calls occur when brokerages request investors who have borrowed from them to either deposit further cash or to unwind their bets, if the market has fallen below levels the broker can stomach. According to analysts, the second margin call tends to be more significant in China, thereby amplifying the selling pressure in the afternoon trading sessions.

“When force-selling kicks in, people just dump their shares hence these blatant downward moves. The sad thing is that this market is so nervous that whenever there’s a big move, the innocent man on the ground follows, fearing that he will be the last man standing,” Singapore-based Teo from CMC Markets said.

3. Timing government support

Another factor underpinning the late-day swings in Chinese markets is the presence of state-backed buying. While these moves usually provide upward support for stocks, they can also work the other way.

“We [have noticed] bigger investors moving out of the market, perhaps worried about the repercussions of a slowdown and the government’s crackdown on short sellers. So they used the opportunity of state support to exit positions … and that usually happens towards the end of the trading session when state buying emerges,” said Aw, adding that Beijing’s “national team”, a coalition of state-backed financial institutions and regulators, usually steps in during the final hour of trading, around 2-3pm local time.

However in recent weeks, authorities have been tweaking their market-support tactics in a bid to be less predictable, analysts say. This could have fueled concern among investors that state support for the stock market may be faltering.

“The [state buying at around 2pm] has become a predictable characteristic in the aftermath of the market crash. The likes of the CSFC are trying different tactics, just like how the People’s Bank of China (PBOC) is going for a different strategy by devaluing the yuan. If I were a fund buyer, I wouldn’t want the market to know my pattern as well,” Teo told CNBC.

Independent analyst Fraser Howie agrees: “Remember they just inflated one of the world’s biggest equity bubbles, they popped it and tried to support it, then a few days ago they said they are not going to support it or at least step in only if it’s a real crisis. [With these changes,] you’re going to get volatility.”

Johannes Eisele | AFP | Getty Images

An investor holds a notebook showing stock market movements, as he sits at a brokerage house in Shanghai, China.

4. Foreign selling

Analysts believe that foreign investors may have played a role in exacerbating the late-day trading action.

“There’s been an absence of news that could have triggered [Tuesday’s steep fall, which started] as soon as afternoon trading resumed. Thus, I think there could probably be overseas selling because by that time of the day, European sellers would have come online,” Teo said.

Since the hemorrhaging began in mid-June, Chinese shares have gradually fallen out of favor with international investors. According to data from EPFR Global, net outflows from Chinese and Hong Kong equity markets reached $531 million in the week to August 12, marking the ninth week of outflows out of the past 10.

|

Baffled by China’s late-day swings? Read this

Analysts says there are a couple of factors fueling the afternoon gyrations in China’s stock market.

|

|||||||

|

Preview by Yahoo

|

|||||||

China Edges Closer to IMF Seal of Approval With Yuan Move

The yuan’s surprise devaluation roiled global markets and drew scorn from Donald Trump. Still, China’s new market-driven exchange rate bolstered its bid to join the world’s most elite currency club.

As the yuan’s fall broke a rally in the Standard & Poor’s 500 Index and prompted a commodities selloff, some U.S. politicians were quick to label China a currency manipulator and raise fears of a new foreign-exchange war. China indicated the Aug. 11 move gave market forces greater say as it tries to sway an International Monetary Fund review to include the yuan alongside the dollar and euro as a global reserve currency.

The shift to the more flexible exchange rate should boost the nation’s case for the yuan to be included in the IMF’s so-called Special Drawing Rights, said Eswar Prasad, a trade policy professor at Cornell University who previously headed the IMF’s China division. The move is “consistent with other signals that China is making slow but steady progress toward market-oriented reforms, such as capital-account opening, exchange-rate flexibility and interest-rate liberalization,” he said.

Coming in the wake of a $4 trillion stock rout and days after a dismal report on Chinese exports, the reserve-currency argument was drowned out in the confusion over the devaluation that led to the biggest weekly loss in Asian currencies in four years. The move also creates potential headaches for U.S. President Barack Obama as he prepares to host Chinese President Xi Jinping at a summit in September.

Congress Objections

“China has done what the Treasury has repeatedly asked for,” said Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics in Washington and author of “Markets Over Mao: The Rise of Private Business in China.” “If a few members of Congress object, that is a problem for the executive branch, not China. It should bolster their chances, it is what the fund asked for. I think the angst about the new system will be alleviated over the coming weeks.”

Trump, who is leading in opinion polls to become the Republican nominee for president, injected the issue into the 2016 campaign, saying Aug. 11 that “‘devalued’ means ‘sucks the blood out of the United States.’” Charles Schumer of New York – – the third-ranking Senate Democrat — has threatened legislation to punish China with import tariffs.

The IMF and the U.S. Treasury have been pushing China to loosen the rigid exchange-rate mechanism that restricts the yuan’s moves. The Washington-based fund only conducts its SDR review every five years and that may have accelerated China’s efforts to get the yuan included in the group of currencies held as reserves by the world’s central banks that currently includes the U.S. dollar, euro, yen and British pound.

The People’s Bank of China said on Aug. 11 that price submissions for the yuan’s daily reference rate must now consider the prior day’s close, foreign-exchange demand and changes in major currency rates. The IMF, which rejected the yuan in 2010 on the grounds that it wasn’t “freely usable,” called China’s move a “welcome step,” while

cautioning the change had no direct effect on the SDR review.

Breakneck Growth

China has been seeking reserve status as part of a campaign to play a larger role in the postwar global economic order designed and dominated by the U.S. Membership of the reserve-currency club would be a crowning achievement after three decades of breakneck growth that saw the Chinese economy take its place as the world’s second-largest after the U.S.

The devaluation may ensure there’s enough time for the emotions to ebb before the Xi-Obama summit, said Arthur Kroeber, Beijing-based managing director at GaveKal Dragonomics, an independent global economic research firm.

“There is no good time to do these things; moreover, it seems clear in retrospect the PBOC did not anticipate the very negative market reaction,” he said. “Waiting until after the summit would have been far too late to build credibility with the IMF.”

IMF Chances

Standard Chartered Plc in Hong Kong revised its forecast for the yuan’s SDR chances to 80 percent by the middle of next year from 60 percent by the end of this year, said Ding Shuang, the bank’s chief China economist.

“The timing chosen was actually fine,” said Ding, who spent a decade at the IMF in Washington as its senior economist on cross-country economic research. “You need to allow ample time to run the new mechanism before review, and leave enough time gap to facilitate its assessment.”

To qualify for the basket, the country must be a major exporter, and the currency must be “freely usable.” IMF staff said this month the yuan trails its counterparts on key benchmarks and “significant work” remains to show it qualifies as a reserve currency. The IMF on Wednesday delayed until September 2016 the date the yuan could be included in the basket, a move staff had proposed to minimize disruption if the yuan was added.

The yuan was little changed Thursday at 6.3953 per U.S. dollar as of 2:48 p.m. in Hong Kong.

Political Element

The IMF executive board, which represents the fund’s 188 member nations, must approve any change to the currency basket, a requirement that adds a political layer to the technical analysis done by staff. The U.S. has 17 percent of votes in the IMF’s executive board.

China’s system of maintaining trading bands to limit the yuan’s fluctuations means the yuan can’t be deemed as freely usable, said Fraser Howie, co-author of “Red Capitalism.” The onshore spot rate in Shanghai is currently limited to moves of 2 percent on either side of a daily fixing set by the PBOC.

“You cannot control your currency for 10 years and take a few actions over the space of a week, and say, ‘Look, we are now a freely usable currency,’” he said. “You need to go through some cycles, and get at least months, if not years of data to show China is allowing its currency to fluctuate through economic cycles.”

(An earlier version of this story was corrected to show the IMF delayed date of yuan’s possible inclusion in reserve currency basket.)

Greece

Greece Gives Order to Pay $3.6 Billion in ECB-Held Bonds Due Thursday

Greece gave the order for the repayment of about 3.2 billion euros ($3.6 billion) of bonds held by the European Central Bank, a Finance Ministry official said, asking not to be identified in line with policy.

Euro-area finance ministers signed off on the country’s third bailout late Wednesday, paving the way for the nation to pay its bills and begin to rebuild its economy. The approval meant funds could be disbursed from the program in time for Greece to be able to make the ECB repayment.

The European Stability Mechanism approved the first transfer of about 13 billion euros out of the 86 billion-euro program, the Brussels-based crisis fund said in statement. Another 10 billion euros will go into a segregated ESM account that is available for bank recapitalization.

Greek stocks and bonds fell on Thursday, with the yield on two-year government bonds rising 10 basis points to 11.56 percent at 11:14 a.m. local time. The Athens Stock Exchange index fell 2.4 percent.

The aid deal comes after months of negotiations between Greece and its creditor nations that saw the country flirting with an exit from the euro area. Lawmakers in Germany and the Netherlands signed off on the planWednesday, after German Chancellor Angela Merkel and Dutch Prime Minister Mark Rutte fought off domestic opposition to push the bailout through.

Greek Prime Minister Alexis Tsipras, who was elected in January on an anti-austerity platform, approved the sweeping economic overhauls attached to the bailout at the cost of seeing his own Syriza party split. Government officials have said he will now consider his next steps, which may include fresh elections as early as September.

Greece will have about 1 billion euros of the first transfer available to shore up public finances after the rest is set aside for debt servicing and repayment of a bridge loan granted in July, the Finance Ministry said in a statement late Wednesday.

Russia

Russia Rewrites Growth Blueprint as Recession Dooms Consumer