8-21-2015 Articles Economy

21

Aug

Global

Markets dragged down by global meltdown fears

Stocks were slammed Thursday, and investors sought in safety bonds, fearing big problems in emerging markets currencies.

Read more: http://www.cnbc.com/id/102935691

Global Correction Seen as U.S. Stocks Succumb to Broad Selloff

Currency and equity markets from Hong Kong to Johannesburg and London were already faltering. Then U.S. stocks joined in.

The stresses that have been building in global markets roared ashore in America on Thursday as the Standard & Poor’s 500 Index tumbled the most in 18 months and helped send the MSCI All-Country World Index to the lowest since January. Until now, the S&P 500 had traded in a narrow range even as China’s slowdown, Greece’s debt crisis and a plunge in emerging-market currencies roiled other markets. The Chicago Board Options Exchange Volatility Index soared 49 percent this week with one trading day remaining.

“As of a couple of days ago, the S&P 500 had held up. Now it’s back in negative territory for the year. I’d suggest there’s still probably more downside in the U.S.,” Mark Lister, head of private wealth research at Craigs Investment Partners Ltd. in Wellington, New Zealand, which manages about $7.2 billion, said by phone. “We’ve been expecting a correction and it looks like we’re getting one.”

Losses earlier in the week in American shares were limited as the rout in emerging-market assets deepened, with developing-nation equities sinking to the lowest level since 2009 and currencies from Malaysia to Kazakhstan tumbling. That changedThursday as the S&P 500 closed below its average level of the past 200 days, wiping out gains for 2015 as investors sought the safety of gold and Treasuries.

‘Very Cautious’

“Unless you are the staunchest contrarian, then these are times to be very cautious,” Chris Weston, Melbourne-based chief market strategist at IG Ltd., wrote in a note to clients. “U.S. markets have held up well of late, being viewed as somewhat of a safe haven. This view seems to have deteriorated somewhat with the S&P 500 closing below its multi-month trading range.”

While declines of this magnitude are more common in Asian and European stock markets, the S&P 500 has gone more than three years without a drop of more than 10 percent, the longest stretch since 2004.

What’s important “is whether current weakness is just a correction or the start of a new bear market,” said Shane Oliver, the Sydney-based global strategist at AMP Capital Investors Ltd., which manages about $119 billion. “Periodic sharp falls in the range of 5 percent to even 20 percent are quite normal and healthy in that they help the market let off steam and the rising trend resume.”

Asian Markets

The MSCI Asia-Pacific Index fell 2.4 percent as of 2:01 p.m. in Hong Kong on Friday, headed for its lowest close since February 2014. Japan’s Topix index sank 3.1 percent, poised for its worst weekly loss since April 2014.

Hong Kong’s Hang Seng Index and the Jakarta Composite Index are on the cusp of a bear market, while the Shanghai Composite Index slid 2.7 percent. Taiwan’s Taiex index closed Friday in a bear market.

South Africa’s rand briefly weakened past 13 per dollar on Thursday for the first time in almost 14 years. The U.K.’s FTSE 100 Index of leading equities has declined 10 percent from its record high in April. The Euro Stoxx 50 Index is down 12 percent fromApril 13 when it reached the highest level since 2008.

“It’s not pretty,” said Lister. “The whole world’s looking a little bit sad at the moment. China still looks really worrying on a number of fronts.”

US

A huge market measure is at a 7-year low

One development has loomed as a marked positive: Declining correlation between individual stocks and sectors.

Read more: http://www.cnbc.com/id/102935745

CHINA

Turmoil latest: China sinks 4%, Europe stocks fall

The Shanghai Composite slid 4.3 percent on Friday, with investors fleeing to so-called “safe haven” assets like U.S. Treasurys.

Read more: http://www.cnbc.com/id/102934324

Shanghai Composite Sinks Toward 3,500 as State-Backed Gains Fade

Chinese economic winter ‘cooling’ world economy

There are growing fears about the health of the global economy after a day of market turmoil.

Across the world share prices and currencies have fallen and the London stock exchange has dropped to its lowest level for seven months.

The slowdown in China, the world’s second largest economy, is being blamed.

The BBC’s economics editor Robert Peston examines the prospects for the world’s economy. (VIDEO)

EUROPE

Europe Stocks Heading for Correction Pare Losses on Factory Data

Saudi Arabia

Saudi stock index hits 7-month low

CNBC?s Hadley Gamble comments on the market pain in Saudi Arabia.

How Much Longer Can Saudi Arabia’s Economy Hold Out Against Cheap Oil?

The oil price was near its lowest in more than a decade, cash reserves were being depleted, emerging markets were in turmoil and Saudi Arabia was beginning to panic.

“It was a very scary moment,” said Khalid Alsweilem, former head of investment at the Saudi Arabian Monetary Agency, the country’s central bank. “And luckily at that point, oil prices started going up. Not by design, by good luck.”

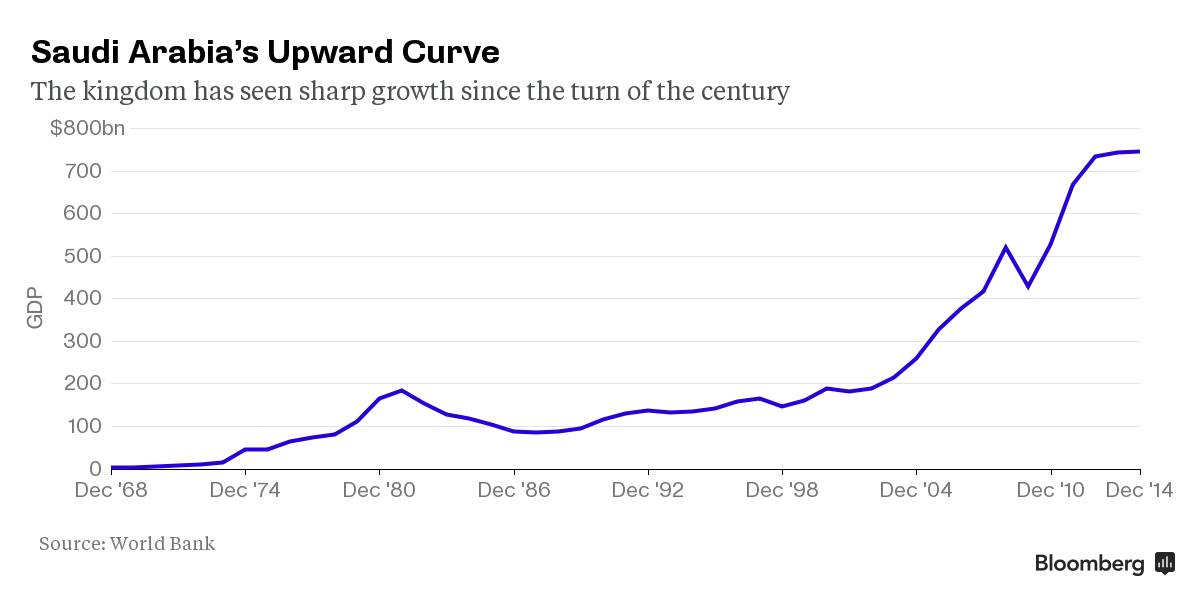

That was 1998, and now Saudi Arabia’s fortunes threaten to turn again. This time, luck might not be enough as the government tries to protect the wealth of a nation whose economy has swelled by five times since then. The bastion of conservative Sunni Islam also is paying for an expanding role in regional conflicts in the face of a resurgent Iran and Islamic State extremists who have bombed Saudi mosques.

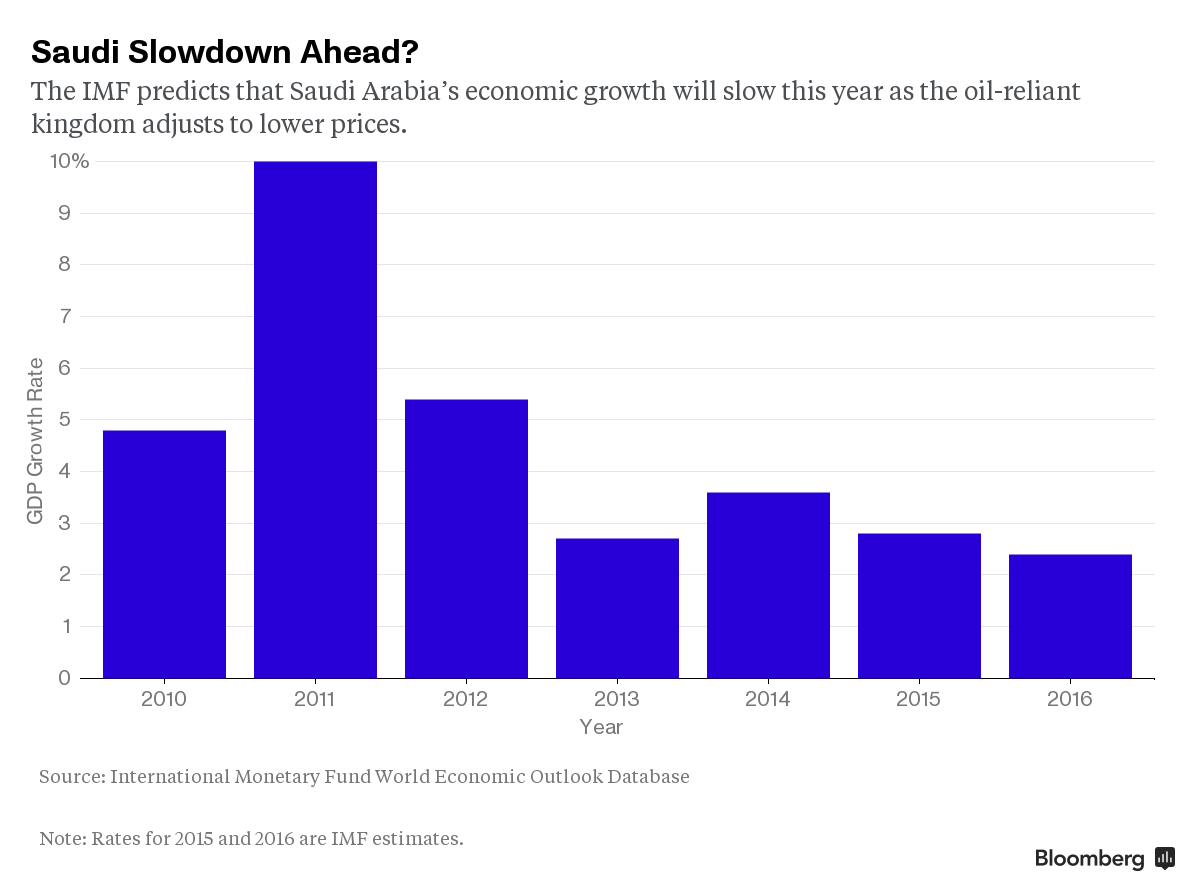

Economists are predicting a budget deficit of as much as 20 percent of gross domestic product and the International Monetary Fund forecasts a first Saudi current-account deficit in more than a decade. Reserves at the central bank tumbled 10 percent from a year ago, or by more than $70 billion.

As a result, bets on the devaluation of the riyal are surging. The Tadawul All Share Index lost 18 percent in the past three months and dragged stocks down across the Gulf region. The benchmark’s moving averages made a so-called death cross on Aug. 18, a sign to some investors that more losses are ahead.

Patient Saudis

The Saudis have “played a waiting game,” Robert Burgess, Deutsche Bank AG’s chief economist for emerging markets in Europe, the Middle East and Africa, said from London. “The budget for next year is going to be a very important milestone that the markets are going to be focusing on quite intently.”

With oil prices down by more than half over the past 12 months to below $50, Saudi Arabia faces many of the same financial problems it did in 1998.

“There’s a long list of things that Saudi officials can do before touching the livelihood of ordinary Saudis”

Waseem Obaidi/Bloomberg

The difference is the sheer cost of maintaining the state as an employment machine and guarantor of the riches that Saudis have become accustomed to since the last squeeze. Subsidized gasoline costs 16 cents per liter and while there’s the religious levy called zakat, there is no personal income tax in the nation of 30 million people.

“The Saudi government can’t continue to be the employer of first resort, it can’t continue to drive economic growth through the big infrastructure projects and it can’t keep lavishing on subsidies and social spending,” said Farouk Soussa, chief Middle East economist for Citigroup Inc. in London.

Taking Action

That’s not to suggest Saudi Arabia is headed for the kind of spending cuts and tax increases more familiar to austerity-hit Europeans. The government, for instance, could first freeze the expansion of two mosques in Mecca or tax wealthy landowners, Jamal Khashoggi, a former media adviser to Saudi Prince Turki al-Faisal, said by phone from Riyadh.

“There’s a long list of things that Saudi officials can do before touching the livelihood of ordinary Saudis,” said Khashoggi. “Yes, it’s a difficult time and maybe it could have been much better if we did what we’re doing today a couple of years ago when the price of oil was in the $100s.”

Fuel subsidies alone will cost Saudi Arabia as much as 195 billion riyals ($52 billion) this year, or 8 percent of GDP

Photograher: John Moore/AP Photo

During those good times, King Abdullah, who ruled from 2005 until his death in January, increased social spending as the Arab Spring uprisings toppled leaders elsewhere.

It’s also not like Saudi Arabia has no control over its destiny. Oil rebounded after 1998 – the price of crude advanced in 11 of the 16 calendar years since then – not least because the Saudis used their clout as the de facto leader of the Organization of Petroleum Exporting Countries, or OPEC.

What Crisis?

The country has declined to cut production and lift prices over the past year to gain market share from the shale industry in the U.S. and other producers with higher expenses, even if that’s come at a cost to its finances. Saudi Arabia still has $664 billion of net foreign assets, equal to almost 90 percent of the economy, and little debt.

“I wouldn’t say there’s any kind of crisis or even a crisis on the near horizon,” said David Butter, associate fellow at Chatham House in London. “They’re in the oil business. They’ve had it pretty good for quite a long time and that’s not typical.”

Even so, the IMF recommends that Saudi Arabia control its growing wage bill, make changes to government subsidies for fuel and electricity and bring in more non-oil revenue through taxes. The country’s breakeven oil price – the point at which it can balance its budget – is about $100, said Soussa at Citigroup.

Deputy Crown Prince Mohammed bin Salman

Hassan Ammar/AP Photo

Fuel subsidies alone will cost Saudi Arabia as much as 195 billion riyals ($52 billion) this year, or 8 percent of GDP, Riyadh-based Samba Financial Group said in an Aug. 18 report. Central bank Governor Fahad al-Mubarak already has called for a review of price subsidies.

A new economic council headed by Deputy Crown Prince Mohammed bin Salman could help make the changes if it can move quickly, said Alsweilem, the former investment chief who is now a fellow at Harvard University’s Belfer Center.

While less per capita than in smaller energy-rich Gulf states Qatar and the United Arab Emirates, the relative wealth of Saudi Arabia means the government might need to tread carefully. Any adjustment will be “jarring,” said Soussa.

“These are things that are absolutely politically explosive,” he said. “You’ve gotten accustomed to a certain lifestyle and that lifestyle is far in excess in terms of luxury that was prevailing in 1998.”

GREECE

EU: Greece must stick with reforms post-election

The European Commission urged Greece to stick to reform commitments, as PM Alexis Tsipras called a snap election within hours of getting bailout cash.

Read more: http://www.cnbc.com/id/102936750