Articles China/Greece

11

Aug

CHINA

Roach Sees Currency Wars Just Getting Worse After Yuan Decision

China’s shock move to devalue the yuan risks opening a new front in a currency war that stretches from the euro zone to Japan as nations look to energize their economies.

The People’s Bank of China slashed the yuan’s fixing by a record 1.9 percent on Tuesday, sparking the currency’s biggest one-day loss since the official and market exchange rates were united in 1994. It triggered the steepest selloff among Asian currencies in almost seven years, led by slides in South Korea’s won and the Taiwan and Singapore dollars. The euro and the yen tumbled 18 percent against the greenback in the past 12 months as monetary policies diverged in the U.S., Europe and Japan.

“In a weak global economy, it will take a lot more than a 1.9 percent devaluation to jump-start Chinese exports,” said Stephen Roach, a senior fellow at Yale University and former Morgan Stanley non-executive chairman in Asia. “That raises the distinct possibility of a new and increasingly destabilizing skirmish in the ever-widening global currency war. The race to the bottom just became a good deal more treacherous.”

China’s devaluation shook global markets just as the currency war appeared to be losing steam in Asia, with Australia and New Zealand toning down calls for weaker rates and Japan refraining from expanding stimulus this quarter. Even with almost all major currencies losing ground against the dollar this year amid rising expectations for increased borrowing costs in the U.S., China maintained a de facto peg since March amid a push for the yuan to win reserve status at the International Monetary Fund.

‘China Blinked’

“They built into the market an expectation that they were keeping the currency stable,” said Ray Farris, global head of currency strategy in Singapore at Credit Suisse Group AG. “Then all of a sudden they blinked. Because they blinked today, markets will continue to look for similar conditions in the future. If exports are falling off a cliff, then against the background of this development, markets will expect more” depreciation, he said.

A report on Saturday showed Chinese exports shrank 8.3 percent in July, compared with a Bloomberg survey’s median estimate of a 1.5 percent. The yuan’s real effective exchange rate, a measure adjusted for inflation and trade with other nations, climbed 13 percent over the last four quarters and was the highest among 32 major currencies tracked by Bank for International Settlements indexes.

Global Use

The depreciation pressure on Asian currencies from China’s action should fade as the nation isn’t aiming at engineering a much weaker yuan, HSBC Holdings Plc analysts led by Paul Mackel wrote in a note. Doing so would contradict the goal of promoting greater global use of the yuan, they wrote.

More than 20 central banks from India to South Korea have loosened monetary policy this year to spur growth and fend off deflation, leaving the U.S. and possibly the U.K. as the only major economies likely to raise rates this year. The consequent dollar strength prompted Federal Reserve officials to comment on its damage to U.S. exports earlier this year, casting doubt over whether it would go ahead with tightening in 2015.

“The devaluation signals the PBOC’s eagerness to join the global currency wars,” Credit Agricole CIB strategists led by Valentin Marinov wrote in a note Tuesday. “With the competitive devaluation gaining momentum but global trade slowing, the latest yuan devaluation could be seen as likely to force other central banks to consider similar measures before long.”

A gauge of Asian currencies headed for the biggest drop since 2008 on Tuesday. Taiwan’s dollar slid to a five-year low, while Korea’s won fell to the weakest level since 2012. The yuan fell 1.8 percent to 6.3231 a dollar in Shanghai. It earlier declined 2.1 percent.

“A stable yuan had served as an anchor of some sorts for the rest of Asia,” said Khoon Goh, a strategist at Australia & New Zealand Banking Group Ltd. in Singapore. “This is no longer the case.”

— With assistance from Kevin Hamlin in Beijing.

China’s Yuan Devaluation Is Great News for U.S. Dollar ( hmmm ya think…..)

China’s decision to devalue the yuan is good news for dollar bulls.

China’s central bank cut the yuan’s daily-fixing rate by a record 1.9 percent Tuesday after the International Monetary Fund last week delayed a decision to endorse it as a reserve currency. The move cast doubt on the health of the world’s second-largest economy, weighing on the currencies of its trading partners and competitors. The dollar was already supported by speculation the Federal Reserve will increase interest-rates as early as next month.

“The dollar story continues to look in almost splendid isolation compared to pretty much everywhere else,” said Jeremy Stretch, a foreign-exchange strategist at Canadian Imperial Bank of Commerce in London. “It just adds to the impetus” for a currency that’s rising because “the growth story is allied to the prospect of Fed tightening upcoming.”

The greenback strengthened against most of its 16 major peers. The New Zealand, Australian, Singapore and Taiwanese dollars tumbled at least 0.7 percent, along with South Korea’s won.

While the dollar has rallied versus all of its major peers in the last 12 months, the bullishness had faded. Forecasters ratcheted back expectations for gains in the dollar after a gauge of the currency fell 1.7 percent in three months ended June 30 amid weakness in the U.S. economy that few predicted. The Bloomberg Dollar Spot Index had surged 20 percent in the previous three quarters.

Reserve Status

The People’s Bank of China had kept the yuan broadly stable against the dollar since March to encourage greater global usage in a push for official reserve status at the IMF. China has been pushing for the yuan to join the dollar, euro, yen and pound in the basket of currencies that make up the fund’s Special Drawing Rights, or SDR.

A strong yuan had put pressure on China’s exports. The nation’s overseas shipments fell 8.3 percent from a year earlier in dollar terms in July, well below the estimate of a 1.5 percent decline in a Bloomberg survey.

“The gain by holding dollar-yuan very steady, in terms of its appeal for the SDR, is now outweighed by the need for a weaker exchange rate as part of looser monetary conditions,” said Sean Callow, a strategist at Westpac Banking Corp. in Sydney. “It adds to the appeal of the U.S. dollar heading into next month’s meeting.”

The Chinese central bank’s move on Tuesday was a one-time adjustment, it said in a statement, adding that it plans to keep the yuan stable at a “reasonable” level and will strengthen the market’s role in determining the fixing.

rate trading for Asia and the Pacific at Nomura Holdings Inc. in Tokyo. “This might be the start of a broader change. That’s why the market is reacting so strongly.”

“They’re saying it’s a one-off, but I don’t think the market’s actually buying that,” said John Gorman, head of dollar interest-

China devalues yuan currency to three-year low

|

China devalues yuan currency to three-year low – BBC New…

China’s central bank devalues the yuan to its lowest rate against the US dollar in almost three years, calling it a “one-off” adjustment.

|

|||||||

|

Preview by Yahoo

|

|||||||

China’s central bank has devalued the national currency, the yuan, to its lowest rate against the US dollar in almost three years.

The lender said the move was a “one-off depreciation” of 1.9% in a move to make the exchange rate more market-oriented.

It comes in the wake of a string of weak economic data from the world’s second largest economy.

At the weekend, China reported a sharp fall in exports and a slide in producer prices to a near six-year low in July.

Exports fell by 8.3% in July, far worse than expected and the producer price index was down 5.4% from a year earlier.

The midpoint for the yuan is now set at 6.2298 to $1, up from 6.1162 yuan on Monday.

The People’s Bank of China (POBC) manages the rate through the official midpoint, from which trade can rise or fall 2% on any given day.

Market-based rate

Until now, it had been determined solely by the central bank itself.

Making the rate more market-based will mean the midpoint will now be based on overnight global market developments and how the currency finished the previous trading day.

China wants to be included in the IMF’s reserve currencies basket

China wants to be included in the IMF’s reserve currencies basket

The POBC’s move comes amid speculation that China is preparing to widen the trading band for the currency from the current two percent range.

China has long kept tight control of the yuan value on concerns over financial volatility and losing its policy control.

Yet it is also under pressure to reform its currency policy as it pushes to become one of the International Monetary Fund’s “special drawing rights” (SDR) reserve currencies.

These are currencies which IMF members can use to make payments between themselves or to the Fund.

‘A new currency war?’

Analysts ask, though, whether this really is a one-time move from China.

“The question on everyone’s mind is whether this is the awakening of the dragon – ushering in a new global currency war?” Angus Nicholson, market analyst with trading firm IG wrote in a note.

“If this move ushers in a new era where the CNY [Chinese yuan] fixing is increasingly reflective of the spot market, it could be positive for its prospects being included in the IMF’s special drawing rights basket of currencies this year.”

Asian equities outside of China slipped on the news as investors weighed the implications of the surprise move.

![]()

Analysis: Robert Peston, BBC economics editor

The decision of the People’s Bank of China to devalue the yuan by 1.9% will have global ramifications, in the short, medium and long-ish term.

Immediately it will increase the competitiveness of China’s exports at a time when the country’s economy is growing at its slowest rate for six years – and when many economists fear that the slowdown will become much more painful and acute.

And for all the spur to growth it may give, the devaluation will reawaken concerns that Beijing is still a million miles from having re-engineered the Chinese economy to deliver more balanced growth based on stronger domestic consumer demand.

Greece

Greece Secures Bailout Deal After All-Night Talks in Athens

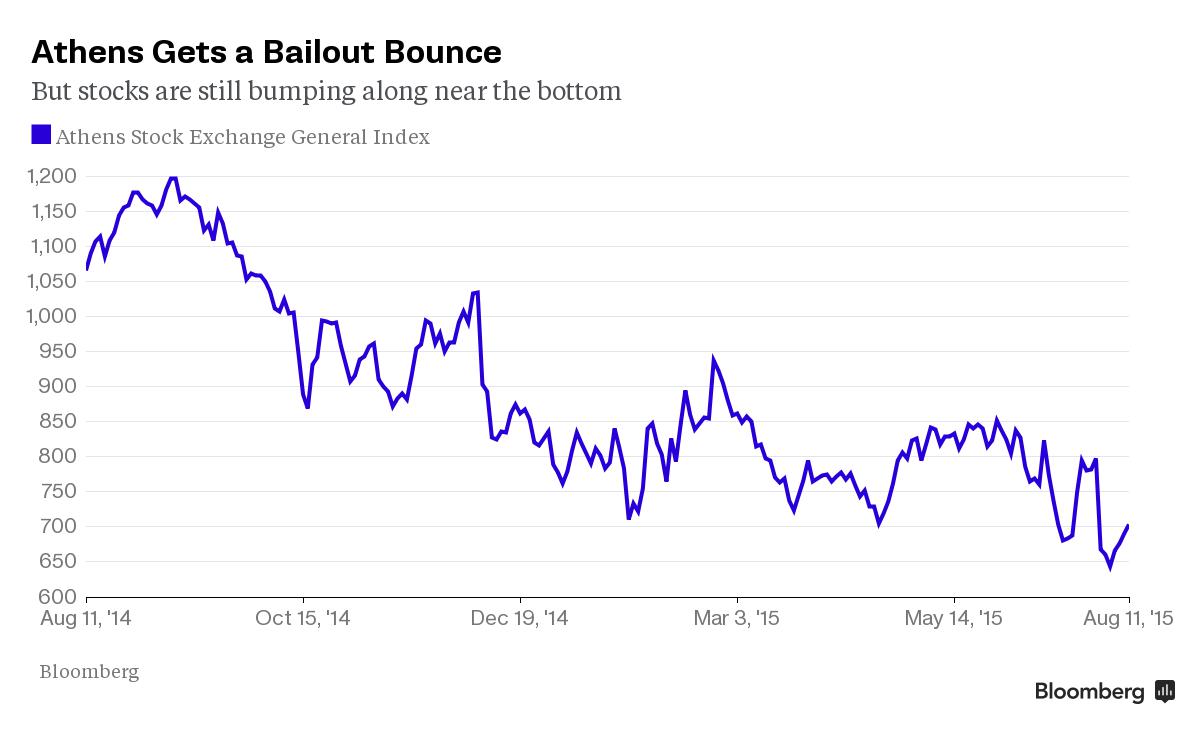

Greece reached an accord with creditors on the terms of a third bailout, paving the way for national parliaments to vote on the deal before an Aug. 20 payment falls due to the European Central Bank.

After almost two weeks of intensive talks, the four institutions representing Greece’s creditors — the ECB, the International Monetary Fund, the European Commission and the European Stability Mechanism rescue fund — agreed on measures and prior actions that will unlock some 86 billion euros ($94 billion) in funds for Greece.

The talks successfully wrapped up in the early hours of Tuesday, Finance Ministry spokesman Theodoros Mihopoulos said in a text message. Finance Minister Euclid Tsakalotos told reporters that just “one or two very small details” remain, in comments broadcast on Skai TV. An EU official confirmed a deal had been struck, asking not to be named because the talks are private and details have still to be announced.

Greece’s parliament must now pass the reform or fiscal requirements before a meeting of euro-area finance ministers tentatively scheduled for Friday. A draft of the memorandum of understanding includes 35 so-called prior actions the country must pass immediately, with more measures to follow in October, before aid can be released, Kathimerini newspaper reported, citing a copy of the draft.

‘Lasting Solution’

Greek Prime Minister Alexis Tsipras’s government needs a quick release of about 20 billion euros to create a buffer for its banks and to make loan payments.

The Athens Stock Index rose 1.8 percent at 10:49 a.m. in Athens after increasing 2.1 percent Monday in anticipation that a deal was near. The yield on Greece’s 2.1 billion euros of 3.375 percent notes due 2017 plunged 352 basis points to 14.7 percent. That’s down from a high this year of 63.3 percent in July.

Greece Agrees to Terms With Creditors for 3rd Bailout

“One needs to look closely and then we’ll ask the Bundestag for approval when the common understanding is that this will hold for three years,” Jens Spahn, a deputy to German Finance Minister Wolfgang Schaeuble, said on ARD television. “It has to be convincing that it isn’t just about Aug. 20 and an installment payment, but really about how, together with the Greeks, we can have a lasting solution.”

People are “too pessimistic” on the likelihood of a deal for Greece succeeding, Erik Nielsen, global chief economist at UniCredit Bank AG, said in a Bloomberg Television interview.

“I don’t know if it’s going to work but I wouldn’t write it off,” Nielsen said on Monday. In any case, Greece won’t leave the euro “because they were out there looking into the abyss and decided they didn’t like it,” he said. “That is not a very big risk.”

The commitment to seek another bailout backtracks on Tsipras’s election pledges, prompting a rebellion within his Syriza party. He has called an emergency Syriza congress for September.

Greece says bailout deal broadly agreed

http://www.bbc.com/news/business-33858660

191 comments

Mr Tsakalotos’ comments came after all-night talks at a central Athens hotel

Mr Tsakalotos’ comments came after all-night talks at a central Athens hotel

Greece says it has broadly agreed the substance of a bailout deal with its creditors, according to Greece’s finance minister Euclid Tsakalotos.

“Two or three small issues,” are yet to be resolved with lenders, Mr Tsakalotos said.

The European Commission said a technical agreement had been reached with Greece, and that a political agreement was pending.

A deal is needed keep the country in the eurozone and avert bankruptcy.

The Greek government is hoping to push the new €86bn (£60bn) three-year agreement through parliament later this week.

The country needs a deal by 20 August, when the country has a debt repayment of about €3bn to make to the European Central Bank.

Greece will not be able to make that payment without funds emerging from the country’s third bailout in just over five years.

Emerging from all-night talks at a central Athens hotel with negotiators representing Greece’s creditors, Mr Tsakalotos said: “I think we are very close.”

“Two or three very small details remain,” he added.

Earlier, Reuters quoted a Greek official as saying an agreement had been reached.

Greece has agreed the function of a new independent privatisation fund, and how non-performing bank loans will be administered, according to the official.

Both issues had been key sticking points in negotiations.

“Finally, we have white smoke,” the official was quoted as saying.

![]()

Analysis: Robert Peston, BBC economics editor

The really hard negotiations start soon – on how to reduce Greece’s massive debts, set to peak at close to 200% of GDP or national income in the next two years (according to the IMF) to an affordable level.

Without debt write-offs, prosperity will never return to Greece, and its future in the euro will never be assured.

With debt write-offs, populist parties throughout the eurozone will be able to claim to voters that they have nothing to fear and everything to gain from throwing out the mainstream establishment parties and re-asserting national sovereign rights to economic self-determination.

Or to put it another way, euro politics and euro economics of Greek debt forgiveness point in diametrically opposed directions.

Which is why no-one should see today’s important bailout agreement for Greece as a permanent happy ending.